Life insurance is considered as the contractual agreement that occurs between the insuring party and the insuring company. This means the protection from the calamity that arises to the insured person. This may be considered in the form of financial protection to the insured person. This is considered as the risk management that helps the insurer to get protection from the contingent event or any unforeseen loss that may occur to them (Stevens, 2017). Here the insurance provider promises to pay to the insured dependent an amount of money which is known as sum assured on occasion of any causality or death.

For availing this service the insured person or his well wisher who is having a interest in the life of the person can pay the amount on his behalf. The insurance provider provides a benefits of paying a small premiums. The premium of the insurance policy is calculated by insurance provider by equating the mean value of the benefits that would be provided to them. It is seen that it is a big issue that is being generated in the insurance industry in South Africa where there exist a Lapse in the payment of the insurance policy full amount.

The term lapse in the insurance sector is defined as a cessation of privileged that the policy holder has due to the passage of time or inaction. This occurs in the insurance sector when the party to the insurance does not pay his or her obligation for availing the service. This is done by the insured so as to make a premature withdrawal of the policy. Here the death of the person is not considered as the matter. Due to lapse the insured person is no longer able to achieve the benefit that arises to them while they were in contract (Mikkelson, 2016). Hence the lapse of the policy should be reduced so that people of the country are fully insured to the danger of life loss during any probability. As it is already been seen in the previous study there are various factors that influence the decision of bringing lapse in the insurance policy of the insured person this report would provide analysis of the factors.

1.2 Motivation for the study

This research topic is one of the most important factor that derives the working of any country as the people of the country should be insured which would make there loved ones life risk free. As this study reflects the factors which are important for the people of the country to evaluate why the lapse of insurance is not good for the family members. As in the country there is no proper information about the rights and the duties of individuals in the insurance contract due to which they lapse the insurance policy before the maturity occurs. As the people of the country are highly affected by the long term insurance practice that insurance providers provide to them.

This study is done so as to make the learner of the study get the knowledge of negative impacts of lapsing the insurance policy before time. The user of this research would be the general public of the country who does not have information of the terms and condition of the insurance (Bloomberg and Volpe, 2018). This research would also help to promote the benefits that are related to the life insurance.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

The stakeholders which would get benefit from the study includes Young age people who are working out of their home and on whom the life of family depends upon, also the factory workers would be the key stakeholders as there exist a chance of causality among them. The learners and the scholars are one of the main stakeholders who will get benefited from the study.

1.3 Focus of the study

This research is based on the factors that affects the Lapse rates in the south African short term insurance industry. The factors which would make the insurance industry affected would be discussed here. This would also include impact of the policy holder attributes on the short term insurance lapse rates. Also the examination of the impact of Macroeconomic variables would be considered in this report. The main aim of the research is to give the user of this research a knowledge about the specific factors that determines the lapse of the insurance policy (Akesson, Â Braganza and Root, 2018).

Also the industrial dimension and the advantages and disadvantages that are related to entering into the insurance contracts would be discussed. This research focuses on the people who lapse their insurance policy before time and gets affected afterwards. However the research will not focus on the insurance industry and the influence that the insurance provider have on the insured person. Also the wrong practices that the insurance provider does to sell their insurance products to the customer would not be analysed in the research.

1.4 Problem statement

As it is seen in the country there exist a problem of lapse of insurance before the maturity of the insurance occurs (Black, 2017). This is considered as one of the main problem which makes the people get hampered and also impacts the nations mortality rate. It is seen that most of the people in country are living without having a insurance policy or if they had taken the policy, they have lapsed it before maturity occurs. There exist a chance of misshapenness which is uncertain due to which the family member of the individual hamper. As if the earning member of the family dies then other family member who are dependent on him would be affected financially leaving the family in poor condition. Also it has been identified that the lapse under certain condition accounts for around 50% of the contracts fair value.

Research is conducted to answer the research questions. It is a fundamental core of any research project. The research is interlined with look into targets as these are made according to the foreordained destinations of the exploration. Inquiries assumes a viable part in leading writing audit with see purposes of different journalists and writers. There are various questions that this research would answer which includes the following:

- What policyholder features determine short term insurance lapse?.

- What macroeconomic variables influence short term insurance lapse?.

- How do short-term insurers manage lapse?.

1.5 Objectives of the Research

Research objectives are basically what we expect to achieve from a research. The  research depends on the examination points on the grounds that in these different targets are readied which are fundamentally interlinked with look into title (Biggam, 2015). This give assistance to the scientist to complete the tasks and exercises of research in orderly way. This also helps in providing solutions to the problem in the research. There are various research objectives that are supposed to be considered in the other chapter of this study.  These research objectives includes:

- To examine the impact of policyholder characteristics on short term insurance lapse rates.

- To examine the impact of macroeconomic variables on short term insurance lapse rates.

- To provide recommendations on strategies to mitigate lapse rates.

1.6 Aim of research

The aim of research is to make known something previously unknown.  It is one of the most critical piece of research venture (Akesson, Braganza and Root 2018). This is because the entire work and movement of research depend on the title and the point of the examination. It consist of  an issue which should be investigated by inquire about for leading an examination work. It will also explain a new phenomenon and will also generate new knowledge for the researcher. The aim of research is stated below:

“Examining factors affecting lapse rates in the South African short term insurance industryâ€

1.7 Methodology

The methodology that is used in this report is quantitative research which emphasize on the objective of the measurements and the statistical, mathematical or the numerical data. Your goal in conducting quantitative research study is to determine the relationship between one thing [an independent variable] and another [a dependent or outcome variable within a population.

1.8 Chapter Outline

The research work to be conducted should be presented in an appropriate format. An appropriate structure for presentation of research work needs to be designed. In present case the researcher is going to follow the structure mentioned underneath.

1.9 Summary

The first chapter which is the introduction specifies about the problem and also states the brief information on the problem that the country faces. Here the methodology and which is used in the study is mentioned and why it is important for the researcher is given. Also this chapter gives the brief about the motivation that makes the researcher to study the research (Alhassan and Biekpe, 2016). This chapter would give a brief proposal on the research that would be examined on the later part of the research. Also the objective and the question which are related to the research problems are stated in this chapter of research.

Chapter Two- Literature Review

2.1 Introduction

The literature review is defined as the both the explanation and the summary of the complete and the current objectives that are defined in the research. These are done with the help of some of the academic books as well as the journal articles which are available either in the market or by internet resources. While doing the research it is seen that there are two types of literature review that can be discussed by the investigator or the researchers. It can be described as the  students paper which is asked by the tutor for doing the stand alone assignment while appearing in the course and other can be described as the part of the introduction which  consist of a longer work which consist of the thesis or the report of the project (Alhassan, Addisson and Asamoah, 2015). The purpose of the report or the thesis that are made by the researcher are based on the research papers that may be used as a primary or the secondary work of another person. The focus and the perspective of the review that the investor depicts in the report will help the user of the research to analyse the focus of the researcher.

This can be understand through the process of reading the published literature reviews or the first chapter which are shown in the dissertation or the thesis. This is the form of review that is based on the articles or has been done by the researcher himself by using various methods of research. This is also known as the scholarly paper that has been done to enhance the current findings and which includes the theoretical and the methodological contribution which is done on a particular topic. These are considered as the secondary sources which are done by the user and it also includes the report that does not shows any new or original experimental work.

The main type of literature review includes, Evaluation, Exploratory, Instrumental literature review and the Systematic form of literature review. The systematic form of literature review is classified separately and is essentially a literature review that is focused on the research questions (Asah, Fatoki and Rungani, 2015). This would help in identifying, appraising and selecting the high quality of evidence for the research to take place.

The purpose of the literature review is to give the researcher to render easy access about the data of the research objectives by the process of selecting a high quality of articles and the studies that are relevant, meaningful, important and valid. This helps in summarising them into a one single research with the help of which the user of the research would be able to get the knowledge about the issue that is being discussed. The literature review helps the user to give a best and absolute starting point for the researchers with the help of which the issue can be  described in best manner. This helps the researcher to not to duplicate the work which has already been done by any other researcher. This also helps the researcher to find the clues that where the research is heading. This also helps in highlighting the key findings of the research.

While discussing the literature in this dissertation the researcher made a focus on the relevant issue that were used to examine the factors that affects the South African short term insurance industry in the country (Babor and et. al., 2017).

2.2 Literature review

Background of South African Insurance Industry

In the words of Marmus van Heerden, CEO, Pineapple, “the insurance is a beautiful concept that and is community that is coming together to help each other. Hence along the way of this we lost touch of insurance the peopleâ€

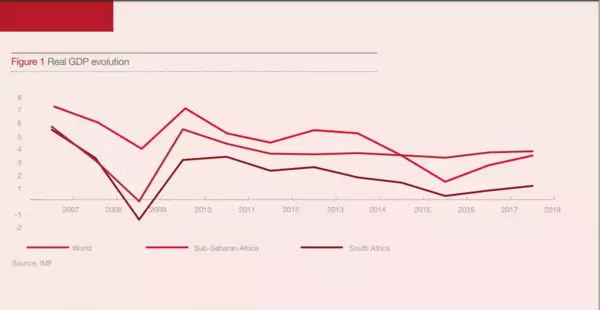

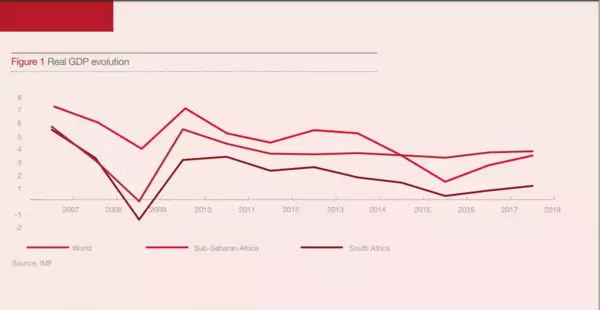

From the analysis of world economic outlook, it is seen that the estimated GDP of the world in the year 2017 was $2.25 trillion of which around 2.8% is contributed by the South Africa. The African insurance premiums in the year 2016 accounted for around $60.7 billion or 1.3% of the global insurance premiums. Which is considered as the one of the most significant figure. Â But the premiums that are paid by the people of the country represents the an insurance penetration rate of 2.8% which is considered as lowest in the emerging industry. Although it is seen that the insurance premiums in Africa dropped more than 15% from the year 2012 to the year 2016. it has been seen that the South African insurance industry is by far the largest African insurance market in the world which is generating around $44Bn of the total premiums of he country.

But it is seen that the South African premiums are decreasing day by day as the north and the east Africa gain is not relevance  (Barrett and et. al., 2019). By global standards, Africa’s insurance industry remains relatively underdeveloped, accounting for just under 1.2% of insurance premiums written globally. The renewed hope for economic recovery, on the back of rising commodity prices, together with the continent’s growing young population, rising literacy levels, and rapid urbanisation are expected to give rise to an increase in insurable lives and assets. An emerging middle class also points to considerable potential for growth. Property and casualty insurance are expected to grow by a compound annual growth rate (CAGR) of 4.3% between 2017 and 2025, much higher than projections in more mature markets

It is analysed that the share of the South African premiums from the year 2011 to the year 2016 fall from 76% to 69%. it is seen that the short term insurance sector in South Africa has been slow and to go digital. It is seen that customers and the citizens of the people are willing for the company to show a digital engagement. For the companies to achieve the objective of making a good platform and decreasing the lapse rate they should reimagine it. It is seen that the industry is expected to grow at R115.2 billion by 2020 (Biggam, 2015). by various surveys that are done by different companies it is seen that short term insurance providers must meet strategic imperatives to meet the changing customers demands and the leverage of the new opportunities. These five imperatives that would help the industry to grow are:

- They should be accessible to the customers

- The insurance companies should form a trust among the people so as that they are able to achieve the objective of maximum profits and the lapse rate may decline due to this.

- The insurance companies must be responsive to the customers feedback and should have a high rate of payment of dues to the customers.

The data that is seen in the life insurance policy surrender and lapse disclosed the fact that policyholders accessed R72.6 billion in benefits in 2017 by surrendering their savings policies. De Villiers says while surrenders are always of concern, it is encouraging that the life industry reported a 9% decrease in surrenders from 2016. In 2016 life insurers had seen a very worrying 16% increase in surrenders from 2015.

The South African Insurance penetration is one of the most highest insurance penetration level as compared from other mature markets in the world. This gives the opportunities to the people of the country and the companies to have a growth in future. It is seen that the GWP of the company seems to tell a different story. This has been seen that GWP has rose from the $15.8Bn in June 2016 to $19.3Bn in the June 2017 (Black, 2018). while the short term insurance experienced a growth from $4Bn to $4.9Bn.

Literature review

As by the comparison it is seen that South African insurance industry is highly competitive and more mature, with the diversified multi Chanel distribution models. In recent years, market regulation has evolved to more restrictive and demanding measures. There are concerns that certain competitive aspects of the industry may be lost as a result of some aspects of the new regulations. Their are various strengths and weakness that are related to the South African industry, which includes

- Strengths: It is considered as well developed and financially sound market, level of competition helps the citizens to achieve the best product for their life. Also the industry has a diversified multi channel distribution model which helps them to achieve the advantage of giving best and suitable products.

- Weaknesses: There is a huge risk of Over regulation in the companies due to which people are not able to perform their obligation properly and it raises the percentage of lapse rate. Also the country is slow to engage in the transformation programmes so as to address the inequality among the people.

This is seen that the Africa has relatively low population density in the comparison with the other countries but it has a fastest growing population which helps them to emerge (Black, 2017).

The South African insurance industry is described as a mechanism which helps the country to reduce the risk that is associated with the life of people. It is seen that if this kind of risk eventuate in the people of South Africa than it may either patrimonial or no-patrimonial. The term insurance according to law is a result of man's effort that creates a financial security in the face of danger to his or her life, person or its estate. It is said that the law in the insurance sector in South Africa consist of rules that are peculiar to insurance i.e. the rules on the insurable interest, subrogation and the double insurance, rules which are applicable to all the contracts terms and the general contractual rules that has undergone the changes in the insurance context. The South African law is governed mainly by the Roman Dutch law  (Bloomberg and Volpe, 2018). The classification of insurance in South Africa has been done as a result of difference that are underlying the legal principles. The criteria in classifying the contracts of insurance are:

- Nature of the interest of the insured

- Nature of the event of the insured against

- The way of recovering the amount under the which the contract terms and conditions are determined

- Also it would be seen that how the profits of the insurer would be dealt with.

The rising literacy levels is considered as one of the driver which affects the lapse rate in the insurance sector. Â The rising lapse rate creates more knowledge about the potential buyers of the insurance and further can empower customers to gain knowledge from the internet and the social media networks.

Richardson and Hartwell gave a report by presenting a brief history on the study of the lapse rates that the country has, in their discussion they considered lapse as dependent on the selling agents “selection of the policy holder and the other prevailing economic conditions†(Noe and et. al., 2017). Â

High lapse of life insurance policies is one of the most serious issue that arise in the market. It is seen that around 20% of the policy holders lapse the policies in the initial year of existence. It was seen that some of the companies and in some of the product lines the lapse rate are higher if compared to other products and other companies. If this seen from the perspective of large base then the lapse rate would be more higher. Due to increase in the lapse rate and due to financial losses in the product category it is seen that there exist a huge amount of dissatisfaction with the products that the insured person purchase (Cohen, 2018). It is seen that when the life insurance contracts gets crystallised then the insurer imagines that the contract of insurance would go for the longer time period till the end of contractual terms or the policy year.

If the policy holder breached the contract and lapse it then it gives the rise to the risk of life and the protection against the life insurance of the person gets interrupted. It is seen that the predecessors of the present day should be insured by the life insurance policy so that they are not exposed to the risk that are associated with the life of the person. As it was seen that the there is no to very low entrance in the industry which leads to adverse selection of the policy. Also as now a days people are aware of the fact that low life expectancy due to which they expects a high amount of death benefits (Fortes, 2018). Due to such flaws in the insurance terms led many companies to bankruptcy.

The term lapse is defined as the event were the termination of the policy is done by the policy holder. It is recognised as the voluntary termination of the insurance policy and the contract that has been entered between the policy holder and the company. In the context of conventional life insurance it is considered as the lapse where the insured person or any person who his paying on behalf of him discontinues the policy before it acquires any of the paid up value or a surrendered value (Deininger and Xia, 2018). This can be divided into various other forms which includes the following:

- Full or partial termination of the contracts

- A mere surrender of the policy where cash refund and no refund is demanded by the client.

- A revivable and non-recoverable contracts.

The life insurance and the pension plans are generally promoted as the long term financial service of the products where these are used as insurance product for getting the protection against the life of the individual and the family members. However the shield that the policy holder has by the insurance policy is upon their will to continue the policy the keep paying the premiums as and when required, this also helps the policy holder to no to withdraw the amounts from the policy for fulfilling the intended goals and the objectives. Also they should not surrender the policy prematurely for the cash value as this gives losses to the insured person.

As it is seen that in the recent years there are different options for investment that are available to the insurer. This helps the investors to require continuous engagement by the insurance companies to help them to understand the benefits of the insurance policy and the risk cover that they are providing to the insured person (Doherty, 2015). As it is seen that there are broadly three types of issues which are included in it, these issues includes, Premium persistency in which the premium is received by the insured person on the basis of terms and condition of the policy. Secondly, Policy persistency where the insured person has not paid out the premium but the policy is also not lapsed without the value and hence carries forward accordingly. Lastly it includes where the funds get depleted by the partial withdrawal of the amount at the judgement of the policy holder. If the policy lapses then the policy holder loses his investment. Their are different reasons or causes of lapse in the insurance sector, which includes the following:

- Alternate investment options: There are various alternative investment options that are available to individuals for making investment. As there include the option of investment of mutual funds, direct equity and other form of investment that which gives monetary benefits to them. This impacts how the individual looks at the benefits that are available to the them. As people consider it as one of the most important decision point. As there are various sources that are available that's why people does not invest in the insurance.

- Customer specific features: It is seen in the past investigation that there are differences in the experience of early lapse due to various factors (Fitchett, Hoogendoorn and Swemmer, 2016). There are various other factors that are affecting the decisions of the people. These factors includes education level, socio economic background of the person, age factor, gender factor, marital status and many more other factors lapses in the past have shown significant differences in experience between business coming from rural and urban socio economic backgrounds. It is possible that to some extent these differences are attributable to lack of communication, access to service etc.

Lapses in the past have shown significant differences in experience between business coming from rural and urban socio economic backgrounds. It is possible that to some extent these differences are attributable to lack of communication, access to service etc. It is seen that the lower value policies, low sum assured and the instalment premiums have higher lapse ratios. Also the small proportion of such lapse occurs due to the malpractices, also the policies that are purchased by the people with the limited resources or from the low income groups are more prone to lapses. Also the financial difficulty plays a significant role in doing the lapsation of the policy (Black, 2017). It is seen that the lapse ratio is higher for the policyholder who are in the younger age group, this happens due to smaller or more uncertain income that they have also there is lack of appreciation and motivation concepts in the products which includes the risk cover, family protections and the old age provisions.

- Product design and choices: It is seen that there are various variety of insurance policy and which the customer buys. This includes that the withdrawal experience would be considered as different for the different plans (Fortes, 2018). Lapse experience may differ between types of plans depending upon factors such as the needs which are met, term of the policy and size of premium. As this is seen that the offering that the product offers to them is considered as one of the most important factor.

It was seen that lowest lapse rate was 11.3%, the medium 13.9% and the high 18.2% for an aggregate lapse rate over all durations of 14.8%. A surprising result, on the other hand, was the convergence of mortality rates at high durations in addition to an increasing trend thought to be related to lapse rates.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Their existed a risk of cyber risk and operational loss data because of which customers were not able to invest in the short term insurance sector. The directives that were performed by the data protection directive later gave the impact that people were able to rely on the terms and conditions and the objectives of the life insurance company and due to this the lapse rate decreased relatively (Johnson and et. al., 2015).

The macro economic factor of the country also impacts the lapse rate in the short term insurance sector. These variables includes the employment, income and the inflation levels of the country. As it is seen that the inflation that the company accounted for in the year 2010 lapsed around 60% of the policies which was considered as one of the most significant variables. Also the buyers confidence is also considered as the factor of the lapse, as it is seen in the insurance sector that the lapse in the policy occurs due to the falling confidence of the users the data shows that around 40% of the policies gets lapsed due to this factor.

The price of the commodity that the insurance industry provides to the users has declined significantly since 2016. it is also a fact that South Africa is on a lower economic growth trajectory as compared to the rest of Africa due to which citizens of the country are not preferring to buy the product of life insurance. This is seen that real growth in the GDP has not reached only 1.5% in the year 2018 as compared from the year 2017 (Jones and Muller, 2016). also the elevated inflation between January to March has eroded the household savings.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

This is seen that the high level of unemployment reduces the payment term of the already unequal society. It is seen that the government budget deficits failed to narrow the gap due to the shortfalls in the tax revenue and it increases the spending on the debt servicing .

The deflation in the economy of the country causes a risk for the life insurer as it depicts the low inflationary environments in the country, due to this the interest tends to drop and it becomes difficult for them to achieve the required investment returns.

As it seen from the factor that the interest rate impacts the insurer profitability and is considered as similar to those of the inflation. Also these factors helps in determining their significance which are related to the investment returns of the particular insurance products that are sold. Furthermore, product features such as being able to withdraw money at any time or the addition of benefits under the original policy terms all influence the sensitivity to interest rate fluctuations (Jones, 2017). Despite a global trend towards consolidation of markets and expansion of larger global insurers into emerging economies, local insurers have outperformed their international counterparts in emerging economies. With emerging economies share of the world’s GDP increasing from 21% to 34%, and in parallel total insurance premiums grew by 11% annually in emerging economies, while insurance premiums only grew by 1.3% in industrialised economies over this period.

The financial sector regualtion act 2017 was also designed help the financial service which will elivate the two primary regulators, being the prudential authority. The passing of the twin peaks Bill helped the insurance sector to increase the reliability on the terms of the contract that were done by the insurance regulators. This also helped the consumers to achieve the objective of securing the life of the people of the country.

Also the factor that includes the tax rate of the country makes the user to determine whether they should invest in the life insurance or not. If there are benefits that are provided to the people of the country regarding tax then they would get motivated to purchase the short term insurance policy.

Provide recommendations on strategies to mitigate lapse rates

Lapsation refers to inability to pay premium for renewal of policies. This is the best way through which individuals are able to continue their policies and enjoys free risk at the time of danger. But there are possibilities that individuals are not ale to pay premium on time, which results in breach of contract. This situation is not relevant for insurance industry and customer too. There are different reasons due to which individuals lapse their insurance policies. This gives negative impact on performance of insurance company (Meagher, 2018).

There are some issues such as dishonesty, higher risk, hidden policies, more rules and regulations at the tome of requirement. Insurance is the secure concept which is planned to secure future. This is the way through which individuals feels that there is requirement of some changes which is relevant for making future safe and secure. But as per research, it is found that people of South Africa breach their contract in between due to different reasons.

There are possibilities that some individuals face personal issues such as lack of financial resources, improper planning related to finance, irregular income, lack of knowledge about terms and conditions of insurance policies, etc. These are the some issues which affects operations in negative manner. Hence this make bad impact on operations of insurance company. This affects their operations in negative manner because people are not willing to provide their premium on time.

- There are many changes taking place in insurance policies because of change in legal laws and regulations. Hence these changes must be communicated to customers, so they are aware about alterations. When customers are aware about changes, then they are motivated and ready to pay premium on time. Policies of premium are paid on regular basis. This helps to maintain long term relations with consumers. But this can be done with motivating consumers with regular discount offers.

- There must be use of different policies which helps to provide satisfaction to consumers and they are ready to pay premium on regular basis.

- There must be regular customer service which helps to provide satisfaction to consumers when they want some accessibility related to services. For instance: customer have some issue related to repayment of premium then, in this case if there is proper customer service, then they are able to resolve their grievances (Mikkelson, 2016).

- There are many clauses which are not revealed properly by clients. So in this case, it affects satisfaction of consumers. Hence in order to deal with it, there must be proper change in plans and policies which is significant and relevant to provide them complete information regarding proper terms and conditions.

- Customer relations are the most crucial aspect which helps to get positive impact because of change in plans and policies. Insurance organisations must have policies which is relevant for making operations fruitful according to change in policies. There must be proper communication technique which helps to reduce communication gap between consumers and company.

With the help of above mentioned recommendations, there is ease in performing operations which is significant and relevant for reducing lapse rate of insurance policies. When consumers are not satisfied with services, then they do not want to continue with these services. According to Ian Horsham there are some measures which has to be used by insurance sector in order to provide satisfaction to consumers. Some recommendations are as under-

- Personal services-T here must be personal services to consumers through which they feel comfortable in sharing their thoughts. This helps to understand their mindset and in case of any grievances it must be resolved. This helps to make positive change in behaviour of consumers because in case of any issue, they can easily contact with insurance help line number and resolve it. There is difference in demand of consumers regarding insurance policies such as family benefits, children education, career planning, future benefits, etc. This helps to get customised services and they feel that their money is invested according to their requirement (Needham, 2018). With customised services, consumers of insurance sector has greater choice which helps to continue with insurance policies. When proper services are provided to consumers, then it is easy to provide option with more benefits and resolving issues faced by consumers. When consumers are valued, then it is easy to understand changes in behaviour of consumers.

- Proper communication technique-Â Communication is one of the important aspect which helps to retain consumers for longer time. It is important and significant to provide best communication technique such as blogs, CRM systems, social media, personal touch, etc. which helps to provide complete information about consumers. Sometimes consumer breach insurance contract because they are not secure regarding their personal information. So with regular contact with consumers clients of insurance sector must provide environment of confidentiality so they are confident regarding their information. There must be use of digital technology with the help of which consumers can access their status at any time. This helps to provide satisfaction to consumers because they have information when they want to access it. In case of any change in policy, immediate instruction related to it must be communicated to consumers (Noe and et. al., 2017). In insurance sector, there is a quote that relationship is equal to revenues. So it is important to use proper communication technique through which regular contact with consumers can be made.

Easy redemption- Redemption refers to withdrawal of money which is invested with insurance company. Insurance is the provision which is reserved for the provision of emergency. So if there is problem in redemption of money, then in this case consumer may feel that this will not work in dander and they breach the contract. Apart from this there must be element of gifts, discount on premium, etc. which is relevant for maintaining long term relations. Hence there must be some monetary benefits which helps them to provide them bes deal under insurance contract.

- Fast resolution of consumer grievance-Â Insurance is the sector in which consumer invest their money so in case many issue, it is responsibility of managers to deal with it quickly. This is the concept which helps to provide satisfaction to consumers. Sometimes, there are so me myths related to insurance policies, so in this case it is responsibility insurance company to clear it and up date at their site, so more and more people can access it. e- mails are the main source through which consumer share their grievance, hence regular check on e-mails helps to acknowledge about issues faced by consumers. With regular solution of grievances, it is easy for insurance firm to expand business at global level.

- Transparency and honesty-Â In insurance sector, there are many terms and policies, so in this case, these policies must be communicated to consumers (Permadi and et. al., 2018). When terms and conditions of insurance are clear to consumers they are satisfied regarding benefits and offers of company. This helps to creates trustworthy relationship between consumers and insurance company. As there are many changes taking place in external environment, so in this case insurance company has to launch new and innovative approaches which helps them to invest and get best return out money invested. With new policies as per consumer demand, consumer feels like insurance option is safe and provides more benefits. This reduces the rate of breach of contract (Walsh and et. al., 2017).

- Measure lifetime values- Insurance is the sector which consumer takes as life time benefits. Hence when marketing of insurance policies, there must be complete information regarding life time benefits. This helps to attracts consumers and they prefers to pay premium timely because there are many benefits which are fruitful because of this payment. This must be done after analysing demand of consumers. Advertisement must be according to plan. For instance: insurance policies is related to future plans or retirement benefits, then in this case there must be television advertisement, online ads which helps to provide relevant information to consumers and they gets convinced to be part of insurance (Stevens, 2017).

- Don't over promise- There are many advertisement which provides guarantee related to provide specific benefits. In this when consumer invest by analysing such advertisement and they do not get such benefits. In this case, brand image of insurance policies goes down. So insurance company must never over promise related to returns and benefits. There are many offers which makes consumer attracted to invest in insurance. But due to lack of proper planning regarding finance consumer breach the insurance contract. So with proper disclosing plans and policies and discount offers, planning related to it can be done. When some offers are launched by insurance company for some specific period, then in this case this point must be disclosed properly to consumers. This helps to enhance their knowledge about offers and they plan actions accordingly.

From the above discussion, it is clear that with following above points, it is easy to maintain long term relations with consumers. This is because they are aware bout actual facts and hence they plan operations and financial resources accordingly. So this helps to reduce lapse rate of insurance policies. This helps to improve condition of insurance sector in South Africa (Titmuss, 2018).

2.3 Summary

This has been analysed from the above review that insurance industry is considered as one of the main industry in the world. People in the country are affected by the variables that impacts the performance of the company. It is seen that insured person lapse the policy due to the macroeconomic factors that affects the countries insurance industry the most. Also the design and feature of the product are considered as one of the most important factor that influence the decision of the insured person to lapse the insurance. It is also seen that there are different options that are available to the people to invest in, these are more profitable and approaching to the people of the country. So this would also be the factor that impacts the lapse of the policy. The countries GDP and the financial condition of the insured person also affects the insurance policy to be paid till the end of the contract (Tladinyane and Van der Merwe, 2016).

It is also seen that by bringing the change in the way the policy are sold to the user and implementing the ethical practice in selling the policy to the users would help them to achieve the targeted profits. Also the countries GDP is not as good as compared from the other countries which is a dominating fact for lapse in the insurance sector. The companies in the insurance sector are not having the technological analysis and are not able to work as per the requirements of the people of the country due to which the lapse rate is increasing every year. Also the option which helps them to invest in other form gave the user benefit of achieving the desired profit as required by them.

References

- Akesson, B., Braganza, M. and Root, J., 2018. Is theory development essential for the social work dissertation?. Social Work Education. 37(2). pp.209-222.

- Alhassan, A. L. and Biekpe, N., 2016. Competition and efficiency in the non-life insurance market in South Africa. Journal of Economic Studies. 43(6). pp.882-909.

- Alhassan, A. L., Addisson, G. K. and Asamoah, M. E., 2015. Market structure, efficiency and profitability of insurance companies in Ghana. International Journal of Emerging Markets. 10(4). pp.648-669.

- Asah, F., Fatoki, O. O. and Rungani, E., 2015. The impact of motivations, personal values and management skills on the performance of SMEs in South Africa. African Journal of Economic and Management Studies. 6(3). pp.308-322.

- Babor, T. F. and et. al., 2017. Vulnerability to alcoholâ€ÂÂrelated problems: a policy brief with implications for the regulation of alcohol marketing. Addiction. 112. pp.94-101.

- Barrett, C. B. and et. al., 2019. The economics of poverty traps. University of Chicago Press.

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies