Dechra Pharmaceuticals plc is UK based manufacturing corporation which has head office in Northwich. Company is engaged in production of veterinary products. Company is listed on London-Stock-Exchange and has significant place in FTSE 250 Index (About Us: Dechra Pharmaceuticals PLC, 2019).

Task 1

Current Market Capitalisation of Dechra Pharmaceuticals:

|

Current Market Cap (USD)

|

Around 2914 GBP million

|

|

Number of Shares (in MM)

|

102.81

|

Book Value of Shareholders' fund of Dechra-Pharmaceuticals:

|

Shareholder's Fund

|

2019 (£m)

|

|

Issued share capital

|

1

|

|

Share premium account

|

277.9

|

|

Foreign currency translation reserve

|

21.6

|

|

Merger reserve

|

84.4

|

|

Retained earnings

|

124.2

|

|

Total equity shareholders’ funds

|

509.1

|

Discussion on Market Value and Book Value Difference:

Book value is simple difference among total assets and external liabilities. While market    value of company is assessed by multiplying market-price of each share with aggregate number of outstanding shares. As in case of Dechra Pharmaceuticals, book value of shareholders' fund is 498.7 which is difference between company's aggregate assets and external-liabilities while Market value is 2914 GBP million with 102.81 million outstanding share (Annual Report of Dechra Pharmaceuticals PLC, 2019).

Main Shareholders of Dechra-Pharmaceuticals:

A shareholder is a person or entity in a publicly or private corporation which lawfully holds one or even more securities or shares. Shareholders can be considered as corporate members. A corporation that retains securities in a listed corporation, like a mutual-fund, banking or insurance corporation. It really is crucial with institutional stockholders to place new stocks and bonds issues because they can actually afford much more of entire issue than individual shareholders (Atanasov and Black, 2016). If majority of securities in a corporation are held by institutional shareholders, company is considered to be under institutional control ownership. In this context following are the main shareholders of company Dechra-Pharmaceuticals, as follows:

|

Company's Main Shareholders

|

Equities

|

Percentage Holding

|

|

Fidelity Management & Research Co.

|

8768222

|

8.53%

|

|

Standard Life Investments Ltd.

|

5597424

|

5.44%

|

|

Royal London Asset Management Ltd.

|

4396255

|

4.28%

|

|

Neptune Investment Management Ltd.

|

4255714

|

4.14%

|

|

Coöperatieve Centrale Raiffeisen-Boerenleenbank (Paris Branch)

|

3672000

|

3.57%

|

|

Aviva Investors Global Services Ltd.

|

3300696

|

3.21%

|

|

Kames Capital Plc

|

3039715

|

2.96%

|

|

The Vanguard Group, Inc.

|

2992732

|

2.91%

|

|

BlackRock Investment Management (UK) Ltd.

|

2845606

|

2.77%

|

|

Legal & General Investment Management Ltd.

|

2706999

|

2.63%

|

Total Borrowings:

|

Â

|

2019 (£m)

|

|

Bank Loans (Current)

|

1.2

|

|

Long term: Bank loans (Non-current)

|

309.6

|

|

Arrangement fees netted off

|

-2.7

|

|

Total Borrowings

|

308.1

|

At Jun-30,2019, £ 128.8 million was borrowed against Revolving-Credit Facility of £ 235.0 million reaching maturity as on July 25, 2024. Facility is not guaranteed on any particular group properties, but is sponsored by a mutual and multiple cross-guarantee arrangement. Interest on such facility is paid at a least of 1.30 percent over LIBOR and a total of 2.20 percent over LIBOR, depending on company's leverage. Interest rate on facility as at 30-June 2019 is 1.70 percent over LIBOR. During year ending June 30,2019, all of the obligations are fulfilled.

At Jun30,2019, £179.3 million had been drawn from the £350.0 million Term-Loan Facility reaching maturity as on December 31, 2020. This facility is not guaranteed/secured on any particular Group assets but is followed by joint and multiple cross-guarantee system. Interest on such facility is paid at a minimal level of 1.10 over LIBOR and a maximum of 2.00percent over LIBOR, depending on entire Group's Leverage (Aggregate Net-Debts to Adjusted-EBITDA ratio). The interest rate on such facility for period ending 30,June-2019 is around 1.50 percent over LIBOR. During period ending June 30th-2019, all clauses are fulfilled. The Term-Loan Facility's maturity period will end on 31st Dec.-2020.

Debt to Equity Ratio:

|

Year 2019 (£m)

|

Based on Book Value

|

Based on Market Value

|

|

Debts

|

539.4

|

539.4

|

|

Equity

|

509.1

|

2914

|

|

Â

|

1.0595

|

0.1851

|

As presented in table, Dechra-Pharmaceuticals' debt to equity ratio in year 2018 based on book value is 1.0595 while based on market value this ratio is just 0.1851 which shows that company is financially stable as its market-based debt-to-equity ratio is below one. Company is able to discharge all its obligations and debts though its market value of equity. While book value of equity is not adequate to pay out its all debts and obligations.

Beta is correlation of anticipated excess return on capital to projected excessive returns on market. Company Dechra Pharmaceuticals' quoted beta is 0.53 (Beta of Dechra Pharmaceuticals PLC. 2019).

Quoted Beta

Competitor Information:

|

Â

|

Shire

|

Otonomy

|

Zoetis

|

Kindred

|

|

Description

|

Biopharmaceutical company

|

biopharmaceutical corporation engaged in development and trading of treatments of diseases of: Middle/inner ear.

|

Producer of medicinal drug and vaccinations for pets and livestock.

|

Veterinary biotechnology  corporation which focuses on development of therapies for pets specially dogs, cats and horses.

|

|

Since

|

Year 1986

|

Year 2008

|

Year 1952

|

Year 2013

|

|

No. of Employees (Approx)

|

23044

|

49

|

10000

|

146

|

|

Valuation ($ in million)

|

54.8

|

73.6

|

52.8

|

310.5

|

|

Turnover (During Year 2018)

|

£43m

|

$745k

|

$5.8b

|

$2m

|

|

Net Profit (During Year 2018)

|

£3.4m

|

($50.4m)

|

$1.4b

|

($49.7m)

|

Recent Financial News:

Dechra Pharmaceuticals being a pharma company is highly impacted by fluctuation in various factors so keep track of these variables is significant for both company and investors. But investors are not so much able to assess all vital information but they get hints through financial news. In this context following are some recent financial news, which could be significant to existing and potential customers (News Results for Dechra Pharmaceuticals, 2019), as follows:

- HSBC has renewed its retained investment rating on company and raised its price targets to 2950p from 2915p.

- Company said that they will proceed attempt towards resolving supply-chain issues and also added that most of the issues had already been mitigated, leaving it 'confident' about its prospects for current FY.

- On 19-Sep. 2019 Chief Executive Officer of company Lan Page has exercised 73,260shares at price of 0.00p and holding reached to 659,910 shares. And on 20thSeptember 2019, he has sold post-exercise 34,536shares at price of around 2789.37p.

- Dechra Pharmaceutical announced a small decrease in earnings, even though the animal-drug manufacturer outperformed in markets, including United States, where organic-growth was extraordinary.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Task 2

Dividend Policy:

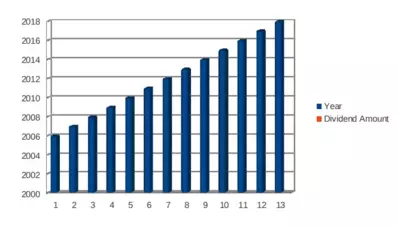

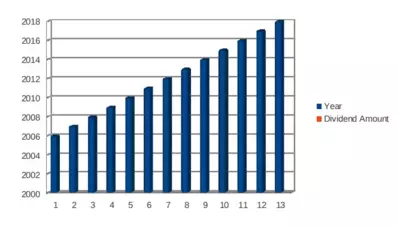

Dechra Pharmaceuticals' dividend history is fair because company is regularly paying dividend on its shares. As shows in above table company has recently paid GBP 22.1 p dividend as on 15 November 2019 which was declared by company on 25th October 2019. Company has not made any default in payment of dividend and almost every year company's directors pays interim dividend. Generally dividend payment pattern of company shows that it pays interim dividend in April month while final dividend is paid regularly paid by company in November/December month. It also a strength of company which attracts stakeholders and investors to make investment in company's securities (Bancel and Mittoo,  2014). Here following table contains dividend payment history of company from year 2010 to 2019, as follows:  Â

Past Dechra Pharmaceuticals plc dividends

|

Ex-Div Date

|

Pay Date

|

Type

|

Amount per share

|

Currency

|

|

03 March 2010

|

01 April 2010

|

Interim

|

3.3p

|

GBP

|

|

10 November 2010

|

10 December 2010

|

Final

|

7.2p

|

GBP

|

|

09 March 2011

|

07 April 2011

|

Interim

|

3.7p

|

GBP

|

|

09 November 2011

|

25 November 2011

|

Final

|

8.4p

|

GBP

|

|

07 March 2012

|

10 April 2012

|

Interim

|

4.1p

|

GBP

|

|

07 November 2012

|

23 November 2012

|

Final

|

8.5p

|

GBP

|

|

13 March 2013

|

09 April 2013

|

Interim

|

4.34p

|

GBP

|

|

06 November 2013

|

22 November 2013

|

Final

|

9.66p

|

GBP

|

|

12 March 2014

|

08 April 2014

|

Interim

|

4.75p

|

GBP

|

|

06 November 2014

|

21 November 2014

|

Final

|

10.65p

|

GBP

|

|

12 March 2015

|

07 April 2015

|

Interim

|

5.12p

|

GBP

|

|

29 October 2015

|

20 November 2015

|

Final

|

11.82p

|

GBP

|

|

10 March 2016

|

06 April 2016

|

Interim

|

5.55p

|

GBP

|

|

27 October 2016

|

18 November 2016

|

Final

|

12.91p

|

GBP

|

|

09 March 2017

|

07 April 2017

|

Interim

|

6.11p

|

GBP

|

|

26 October 2017

|

17 November 2017

|

Final

|

15.33p

|

GBP

|

|

08 March 2018

|

06 April 2018

|

Interim

|

7.33p

|

GBP

|

|

25 October 2018

|

16 November 2018

|

Final

|

18.17p

|

GBP

|

|

07 March 2019

|

08 April 2019

|

Interim

|

9.5p

|

GBP

|

|

25 October 2019

|

15 November 2019

|

Final

|

22.1p

|

GBP

|

Dechra Pharmaceuticals plc dividend totals:

|

Year

|

Dividend Amount

|

Change

|

|

2006

|

6.24p

|

Â

|

|

2007

|

7.5p

|

20.20%

|

|

2008

|

8.25p

|

10.00%

|

|

2009

|

9.1p

|

10.30%

|

|

2010

|

10.5p

|

15.40%

|

|

2011

|

12.1p

|

15.20%

|

|

2012

|

12.6p

|

4.10%

|

|

2013

|

14.0p

|

11.10%

|

|

2014

|

15.4p

|

10.00%

|

|

2015

|

16.94p

|

10.00%

|

|

2016

|

18.46p

|

9.00%

|

|

2017

|

21.44p

|

16.10%

|

|

2018

|

25.5p

|

18.90%

|

Further as per chart prepared based on data of total annual dividend shows that company is continuously increasing dividend payments. However percentage change in dividend showing increase and decrease but overall there is growth in dividend payment. Â Â Â

Theories of Modigliani & Miller:

Modigliani-Miller or MM theories demonstrates that corporation's overall market value is assessed though applying earning power and risks emerged with underlying assets, and  autonomous of manner it distributes share dividends or finances investments. Here three major methods corporation can select for finance: borrowings, utilising profits and issue of securities. This theory is simply based on concept that there is no major variation between company finance itself with equity/debt along with certain assumptions (Bazdresch, Kahn and Whited,  2017). Following are some key assumptions of modigliani-miller approach:

- Taxes are ignored totally.

- Transaction costs related to trading of securities are assumed to be nil.

- Investor/stakeholders have accession as company has to company's information so they act rationally.

- Borrowing costs are same for both investors/stakeholders and companies.

- Floatation cost is considered as nil like underwriting commissions, expenses towards merchant bankers, promotional expenses etc.

- Also here no corporate-dividend tax exists.

As in case of Dechra Pharmaceuticals this theory points that value of leveraged-company has both debts and equities, is same if company is considered as unleveraged by considering only equity when overall operating profits and future projection are matched. Company's capital structure is proper and company is leveraged-firm which has both debt funds and equity funds (Berg, Saunders and Steffen, 2016).

Practical Issues in company:

During September-2019 month after publishing full-year outcomes/results about performance company indicated that it is struggling with supply-chain problems at several sites or units and with contract-manufacturers. As company has wider range of distributors and suppliers along with contractual manufacture, managing and tracking them is tuff task for company. In several units company's inventories are lost, improper supply and excessive storage which is directly affecting company's operating cost. Company is also faced problem of shortage of supply which impacted company's sales in respective area.

Task 3

WACC:

Weighted Average Cost-of-capital or WACC implies to assessment of corporation's cost of capital whereby each class or form of capital is proportionally classified or weighted. Origin of capital involves company's common stocks, preferred stocks, bond issued and other long-term debts are generally used in WACC computation (Damodaran,  2016). With increment in WACC percent, company's  beta as well as return percentage on equity employed also increases since increment in WACC leads to decline in company's valuation and increment in involved risk. Following is key formula  for deriving WACC, as follows:

WACC = VE x Re + VD x Rd x (1− t)

Here in in above formula:

Re (%) = Cost-of equity

Rd (%) = Cost-of debt

E indicates to Market-value of corporation's equity

D is Market-value of the corporation's debt

V => E+D => Aggregate market-value of company's capital structure

E/V = % of financing through equity

D/V = % of financing though debt

t = Average Tax Rate

Cost of Debt: It simply regarded as rate or percentage a corporation pays against its overall debts, like term loans, bonds. Crucial difference in cost-of-debt and cost-of-debt(after-tax) is  concept that interest-costs are tax-deductible. It is denoted by Rd and for computation of it company's average interest rate is assessed first (Dang and Yang, 2018). Following is computation of cost of debt of company Dechra Pharmaceuticals, as follows:

Interest expense (As of June,2019) = $ 13.3079847909 Million

While company's overall Book Value of Debt (D)= $ 388.797680204 Million

Cost of Debt = 13.3079847909/ 388.797680204

= 3.4229%. Â

Cost of Equity: It relates to return in percentage form a corporation requires to determine in case investments meets targets of capital return. Corporation generally apply it as tool of capital budgeting with respect to required/expected rate of return. Corporation's cost-of-equity shows compensation market-demands with exchange for asset and ownership-risk. Generally CAPM model is applied to assess the cost of equity (Dang and Shin,  2015). Following is formula for deriving cost-of equity as follows:

Cost of Equity = Rf (Risk-Free Rate of Return) + Beta of Asset * (Expected Return of the Market - Risk-Free Rate of Return)

In this context here is the computation of  cost-of-equity of Dechra Pharmaceuticals, as follows:

Current risk-free rate = 0.63730000%

Beta = 0.53

Market Premium or (Expected Return of the Market - Risk-Free Rate of Return)= Â 6%

Cost of Equity = 0.63730000% + 0.53 * 6% = 3.8173%

Based on the outcomes of cost-of-debt and cost of equity following is computation of WACC of Dechra Pharmaceuticals, as follows:

Weighted equity = E/(E +D) = 3686.796 / (3686.796 + 388.797680204) = 0.9046

Weighted  debt = D /(E +D) = 388.797680204 / (3686.796} + 388.797680204) = 0.0954

Recent 2-year Average Tax Rate of company (Tc) = 18.03%

|

So, WACC

|

=

|

0.9046

|

*

|

3.82%

|

+

|

0.0954

|

*

|

3.4229%

|

*

|

(1 - 18.03%)

|

|

Â

|

=

|

3.72%

|

Â

|

Comment: Higher percentage of WACC, normally an indication of higher risk connected with corporation's performance. Investors or stakeholders requires extra return to neutralise extra risk. Here as per above computation company's WACC is around 3.72% which below the reported ROIC % i.e. 6.94% of Dechra Pharmaceuticals. Which shows that company has no additional risk since WACC is below the return on invested capital. The WACC of a corporation could be considered to predict all its funding costs anticipated. This involves loan repayments (cost of debt-financing) as well as the required rate-of-return generated by holding or equity financing.

Task 4

Part a) Estimation of share’s value of Dechra Pharmaceutical through SVA model

The Shareholder Value Analysis is one of the key approach to management of financial development in 1980 it extracts on the formation of the financial value for shareholders calculated by share price performance and fund flows. This helps in understanding the investment decisions and strategical approach identified to analyse the impact of value creation for shareholders. It remains essential to calculate the shareholder value analysis in order to understand the financial performance of entity (Dewally and Shao, 2014).

Shareholder value analysis of Dechra Pharmaceutical

The above graph presents the share price valuation of Dechra Pharmaceuticals PLC (DPH.L). It is observed that the share price value is consistently increasing during the mid of 2019 however in third quarter of 2019 the share price of company gets decreased. The maximum share price was recorded £30.36 in Sep 2019. Sales figures is recognised as a key element regarding enhancing the shareholder value of Dechra Pharmaceutical Plc. Relative to GBP 34.1 billion a year earlier, operating profit was GBP 39 million. According to GBP 36.1 million per year earlier, net income was GBP 30.9 million. Average earnings per share equivalent to GBP 0.3724 a year earlier was GBP 0.3015. Compared to GBP 0.3704 a year earlier, adjusted earnings per share were GBP 0.3007.

The above information presents the market performance of organisation. It is resulted that the return was recorded as 28.1% for GB Pharmaceuticals it was recorded as 17.1% and GB market was analysed as 8.7%. the standard rate is expected to grow in near future.

The above shareholder returns present the favourable price volatility and market. The market of DPH on 7-day return is -1.2% and industry is 0.5% and market return is 0.9%, 30 day returns are measured as 4.0% DPH, industry is analysing as 0.1% and -0.5% as market growth. Day 90 return presents the following results as -2.8% and 4.8% for industry and market return of 0.9%, the figures for the market return for one year presents 8.7%, for industry it states 17.1% and DPH market return was recoded as 28.1%. the three-year return was recoded as 112.3% and industry evaluation was made as 35.6% and market value recorded as 3.6%.

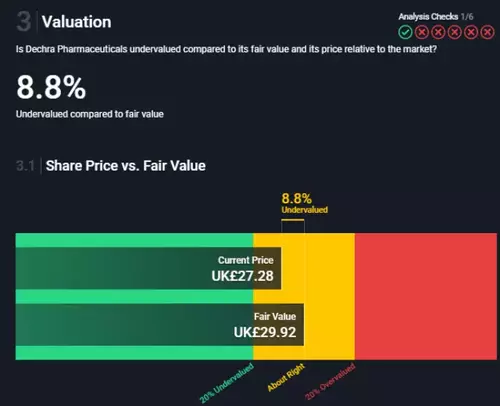

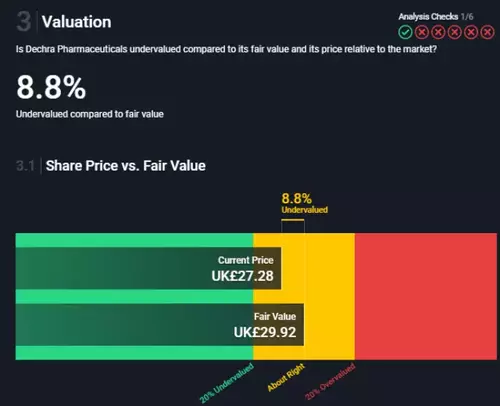

The above data presents the undervalued compared to fair value of organisation. it is resulted that the current price of share is £27.28 and fair market value is £29.92 that clearly shows a difference of £2.64 for the upcoming years. The price is undervalued by 8.8%.

Part b) Rationale for adjustment made to the particular data

The Shareholder Value Analysis (SVA) presents favourable outcomes subject to growth. Such as per the below mentioned graph, it can be find out that company's annual earning is different in various segments. Such as in the terms of industry it is of 22.4% and in the market this is of 12.4%. Along with the forecasted annual revenue growth is of 7.3% in the industry and 3.6% in the market.

In the aspect of EPS growth forecast, this can be find out that it is declining during year 2018-19. While in rest of years, this is increasing in a significant manner.

Task 5

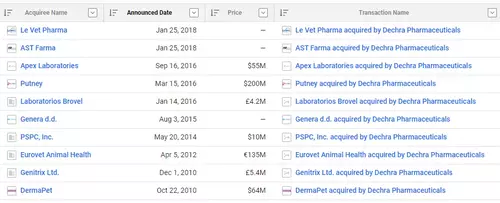

Recent merger and acquisition by Dechra Pharmaceutical

Consolidation of organisations are commonly recognised as Mergers and acquisitions (M&A). Consolidation is the merger of two firms to become one, distinguishing the two concepts, while Purchases are one company that is bought over by the other company. M&A is among the most important aspects of corporate finance (Ehrhardt and Brigham, Â 2016). Typically, the rationale underneath M&A is that two different companies around each other create more wealth than they are on a stand. With both the goal of maximizing assets, business continue to evaluate different prospects via the merger or acquisitions path.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

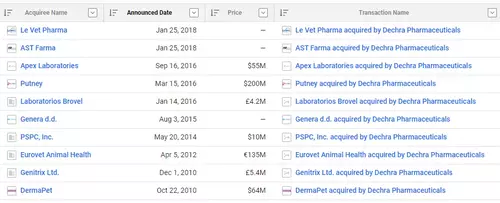

Recent mergers and acquisitions by Dechra Pharmaceutical

Â

Â

(Source: Mergers and acquisitions by Dechra Pharmaceutical, 2019)

The two major acquisition in the history of Dercha Pharmacutical industries are discussed below:Â

Acquisition of Dutch animal Pharma companies for €340 million

The above merger and acquisition status presents the recent mergers and acquisitions made by Dechra Pharmaceuticals in which Le Vet Pharma is one of the recent acquisition made on 25, Jan 2018. It acquired Dutch firms AST Farma, Le Vet for $422 million. It is recognised as a big acquisition in the history of Dercha. It paid 75% cash in favour of debt free and cash free agreements and 25% in the form of new Dercha shares with a two year’s lock in period. AST Farma was an animal pharmaceuticals firm that was expert in generic components whereas Le Vet Focused on the European Markets outside of the Netherlands. Dechra plans to increase about 100 million pounds ($142.5 million) from investors to finance the transaction by selling 5.1 million new ordinary shares at 2.050 cents each. This merger was considered a great opportunity and synergy effect to Dercha Pharmaceutical subject to EU segment in all major European countries.  Paediatric company Dechra Pharmaceuticals Plc announced that it would purchase a number of € 340 million ($422.1 million) from either the Netherlands-based AST Farma and Le Vet in a money-and-share deal to increase its European existence.

Acquisition of Putney, Inc for $200 Million

The Dechra Pharmaceuticals plc decided to acquire of US based Putney, INC for $200 million. Dechra Pharmaceuticals PLC (LSE: symbol DPH) announced the contingent purchase of the whole capital stock of Putney, Inc., a major synthetic animal drug companion company located in Portland, Maine, USA. "In accordance with existing approach, Putney's purchase will dramatically improve Dechra's role of the us, include Health canada-approved veterinarian services of good quality and extend the portfolio. it is leased to capture this rare opportunity that brings scope and extensive experience to the North American sector."

This merger conveyed various opportunities regarding expanding the operations significantly. The strategic significance of this acquisition is as follows;

- The critical mass to Dechra in the global companion animal market.

- Enhancing the Dechra’s North American operational strategy and make a potential business planning horizon.

- The key strength of the business group’s pipeline for the US

- Forming Putney’s regulatory expertise and commercial team

- Delivering the synergies while containing the resources required in Portland (Acquisition of US-based Putney, 2016).

Potential sources of synergy among parents and acquired company

The acquisition of Le Vet Farma lead Dercha Pharmaceutical to capture pharmaceutical market in the starting of 2018. The share price of Dechra increased by 3.8% and share priced reached up to 2140 pence. The company also issued 3.67 million new ordinary shares to stakeholders. This acquisition builds a strong hold on market and capital structure for Dercha.

Acquisition and placement anticipated to be earnings improving in fiscal year 2017 and substantially improving income in fiscal year 2018 as well as subsequently (on the grounds of the fundamental result) Development meets the economic return requirements of Dercha Pharmaceutical. Takeover subject to review by U.S. regulatory bodies. it is observed that Putney has centralised towards targeting the veterinary products subject to limited competition and the large market demand. The organisation has a veteran regulatory team with an effective track history that provides clear sources of synergies among the Dechra and Putney Inc. Company achieved over 40% of the overall US companion animal basic endorsements since 2012. It also outsources manufacturing services with significant market share agreements on a fee for service basis.

Dechra claims that, although retaining the resources in Portland, there will be potential for synergies. It could also be possible to make in-house goods in the system in the potential, that are not currently identified with private entities. Putney has been regarded as the most competitive investment prospect found in the United States for Dechra for whatever period. The purchase gives access to the current Putney product line and growth portfolio, including heavy-quality and compatible therapeutic target areas, while bringing mass to the existing US activities and assets of Dechra. It will be able to utilize its product development departments and distribution from Putney, and share methodologies in product design and compliance fields. Therefore, for the company, Discount charged.

Premium paid for the target company

At finalization on a mortgage-free / money-free basis, its complete examination receivable for Putney adds up to $200 billion (£ 139 million) in cash. Established in 2006, Putney released its first Carprofen caplet veterinary brand in 2009. The development is subject to Dechra being granted clearance under that same Hart-Scott-Rodino Regulatory Enhancements Act, which is anticipated to be obtained by mid-April 2016 at the latest. Furthermore, Dechra proclaims that this has positioned 4,398,600 current normal shares at 1100 cents per share to increase about £ 47.1 million, net of expenditures, to express the purchase. It was a leading international manufacturer of pet generic drugs in the United States, centred in Portland, Maine, and employing about 60 staff. Putney currently markets 11 drugs in adjacent therapeutic fields to Dechra, like pain control, anti-infective and dermatology, that have gained strong market shares but continue to expand.

Conclusion

As per above report it has been articulated that Dercha Pharmacutical is well financial structured corporation. Company's market cap is major as compare to its competitors. However company is facing problem regarding supply-chain but company's recent statement indicates that company has overcome this problem. Also company's WACC is favourable and assured dividend policy are key factors which attacks investors. However it has been recommended to improve their supply-chain shortly to maintain current market cap and brand value in industry. Alos company has mentioned this issue as confidential in annual report which may distract company's existing and potential investors. Â Â Â Â Â Â Â

References

- Atanasov, V .A. and Black, B. S., 2016. Shock-based causal inference in corporate finance and accounting research. Critical Finance Review. 5. Â pp. 207-304.

- Bancel, F. and Mittoo, U. R., 2014. The gap between the theory and practice of corporate valuation: Survey of European experts. Journal of Applied Corporate Finance. 26(4). Â pp. 106-117.

- Bazdresch, S., Kahn, R. J. and Whited, T. M., 2017. Estimating and testing dynamic corporate finance models. The Review of Financial Studies. 31(1). Â pp. 322-361.

- Berg, T., Saunders, A. and Steffen, S., 2016. The total cost of corporate borrowing in the loan market: Don't ignore the fees. The Journal of Finance. 71(3). pp. 1357-1392.

- Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate finance (Vol. 324). John Wiley & Sons.

You may also like to read : ACCT6003 Financial Accounting Processes, Laureate International University

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies

Â