The report discusses about BHP Group Limited which is a leading company in the mining and natural resources sector, excels at commodity commodities such as copper, nickel and potash. How the company could get through the external challenges like the fluctuating commodity prices as well as the geopolitical risks. This conservative debt policy of BHP has enabled the company to retain a strong balance sheet with good credit ratings. BHP has the operational excellence and the strategic investments in high growth sectors to make the company grow sustainably. In analysing BHP’s past financial position, future growth over the next 5 years and its financing strategy, this report will be under taken. Revenues and EBITDA are projected to grow steadily based on financial numbers from FY2023 and FY2024. Nevertheless, profitability may be affected due to external shocks as for example tariffs, market volatility. BHP should concentrate on liquidating costs and relying on the internal reserves for financing. On the other hand, before entering into any additional debt, the company has to be wary. BHP has a strong financial base and a forward viewing strategy that positions the company well to face the market challenges and to capitalise on long term growth opportunities. If you're seeking expert guidance on topics like this, our Finance Assignment Help service can assist you in mastering complex financial analysis with ease.

Get It Done Today

An overview of debt policy determinants of the firm

Debt management is one of the major strategic objectives of firms that determine the capacity in financing operations. There are various conditions relating to both internal financial structure and external market environment that influences the debt policy of any firm. Below are the key determinants:

- Cost of Debt- Regarding a company’s debt policy, cost of debt is a major component that working under the convection of interest rate charged on the borrowed money. Thus, if interest rates are low, it means that cash is cheap and firms are likely to use debt to finance them since it enables them to reduce the cost of capital in the business (Ahmad, Bakar and Islam, 2020). On the other hand, high interest rates are costly to firms that use debt to finance their activities, this leads to firms to find other sources of funds to finance their businesses.

- Financial Flexibility- Financial flexibility relates to the capacity of a firm to respond to change in certain conditions in the market or other unforeseen cash requirements. Greater financial leverage means that a number of companies can respond to the prerequisites of their operating cash flow and specific conditions in the working environment by increasing or decreasing their amounts of debt (Schroeder, Clark and Cathey, 2022). The high level of financial flexibility is a good reason for the firm to use higher leverage because it can always adjust the level of debt/ Assets through floating and other means.

- Risk Appetite- Debt policy is one of those corporate policies that bear a strong relation with the firm’s risk tolerance. Companies that can afford to take on substantial amount of risk have a buying capacity to take maximum amount of debt to get maximum returns whereas the companies with less risk appetite they have a preference to go for more equity financing so that their obligation is low. The high amount of debt leads to high risk of the organization especially in the situation when its revenue is low due to the economic crisis. Therefore, a firm’s risk profile also defines its debt capacity so as to differentiate the maximum amount it can leverage on from that it can borrow to fund its equity investment.

- Profitability and Cash Flow-Capital availability and its cost are crucial when reviewing a firm’s eligibility in terms of issuing debt to its financial structure (Brealey, Myers and Marcus, 2023). Organization that has high profits and steady cash reserves are more comfortable with servicing a debt thus utilizes the leveraging factor competently.

- Tax Considerations-Tax deductibility of interest cost is one factor making interest costs appealing to companies as means of funding their projects. Interest on debts is tax on its own, this mean that the interest paid by the company will minimize its taxable income and therefore the cost of borrowing. It increases the value of debt as source of funds to the firms since it reduces the cost of borrowing more than the cost of equity where the payment of dividends is not tax-deductible

Current debt policyÂ

The conservative tax policy of BHP Group Limited achieves the ideal balance of debt with cash flows and capital requirements to fulfil financial flexibility. BHP has a moderate approach to debt as it borrows only when it is favourable, thus lowering the cost of debt without leaving enough liquidity to fund investments and shareholder returns (Nurdiansari et al., 2022).

Comparison to Capital Structure Theories:

- Trade off Theory: that other than the balance of BHP's debt (the interest deductibility) to its costs, for example, of financial distress - paying to maintain strong credit rating.

- Pecking order Theory: BHP’s debt policy is also similar to this theory in the sense that it gives priority for internal financing and will use external debt only when it is necessary and will try to avoid carrying minimum equity.

- Emerging Approaches: BHP has recently started using sustainability linked financing in its debt policy and taking on green or ESG linked debt instruments, among a wider trend of using capital structure management that takes into consideration environmental and social goals.

It employs this strategic debt management so BHP can fund its growth, enjoy stability and quality of shareholder value (Lee, 2020).

Writing Academic Documents Seems Challenging ? Get Top-Notch Assignment Help at Your Fingertips!

Hire For Success ![cursor]()

Optimal debt policy – current and forward lookingÂ

In order to find out whether BHP Group Limited’s current debt is optimal and whether it should borrow more or pay off its debt; there are many financial factors that should be looked into based on the current company finances and conditions as well as project for next five years.

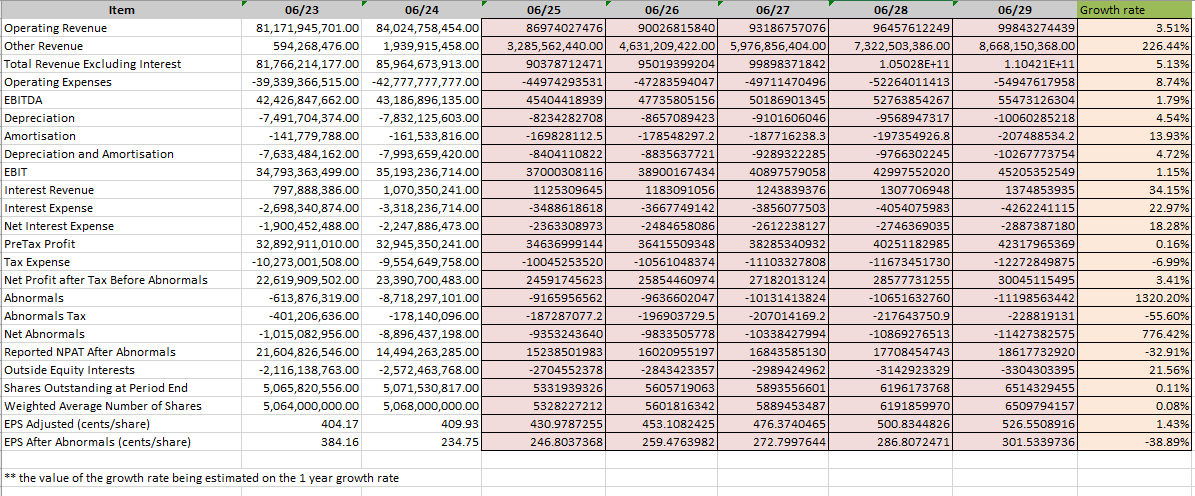

Current Debt and Financial Projections

BHP is projected to develop moderate but stable revenue and EBITDA growth rates in the next 5 years based on the projected rates of revenue (3.51%) and EBITDA (1.79%) deriving from BHP’s financial performance in FY 2023 and FY 2024. Based on the assumption that the company will remain operational efficient, keep costs in check, and continue its strategic investments for growth in areas such as copper, nickel, and potash, these projections are generated.

BHP’s financial data, in particular revenue and EBITDA, suggests that the company is able to hold a conservative debt structure and that the cash flows are sufficient to support its obligations (Maynard, 2017). Overall, the financial condition of the company, its ability to service debt, will be based on such of external factors as commodity price fluctuations, operational risks and macroeconomic conditions.

Debt Analysis

BHP’s debt policy is conservative and is aimed at ensuring a good credit rating and liquidity position. That being said, this follows the trade-off theory of capital structure that seeks to reconcile the tax advantage of debt versus the costs of financial distress (Vernimmen Quiry, and Le Fur, 2022). BHP can comfortably service its current debtor with stable projected revenues and EBITDA growth.

Still, there are many factors involved when it comes down to whether BHP should increase the amount it is borrowing or whether to pay off debt.

- Lowering of interest rates: BHP’s financing can be effected by lower interest rates, which would allow the company to borrow more, to execute its strategic initiatives, which can include expansion into green technologies and sustainability based projects.

- BHP’s exposure to Debt Levels and leverage: If commodity prices falter, there is little chance that BHP will be able to retain leverage in the form of resorting to debt. Thus, then, BHP may want to pay down debt if its debt lever radio is too high relative to the company’s operational risks (Hoggett, et al., 2024).

- Implications:If BHP places sustainability and the decarbonisation project as strategic objectives, it may consider issuing ESG linked or green debt to finance the remaining portion of such projects while not overleveraging its balance sheet.

Are You Still Confused?

Buy Our Academic Writing Services and Get Quick Help from Our Experts to Fetch HD Grades.

Funding decision for new investmentÂ

The firm need to consider the optimal funding mix from the standpoint of its capital structure, risk profile, and growth objectives.

- Debt Financing- BHP’s conservative debt policy and revenue and EBITDA growth projections of the steady kind make borrowing an attractive proposition. Unless debt is used to finance BHP, no equity is issued; no dilution exists and the facility can also benefit from tax deductibility of interest expenses, potentially the least expensive source of capital. Yet, raising borrowing would drive a firm’s leverage, increasing the exposure to financial risk.

- Equity Financing- The company will not increase its leverage by issuing new equity, but it would dilute its current shareholders’ ownership. This may be a good strategy for BHP to comply with its objective of not increasing debt load and have a conservative balance sheet. In reality, investors require a higher return on equity compared to debt and thus the cost of equity is usually higher (Revsine, Collins and Johnson, 2021).

- Internal Reserves- Being able to use internal reserves (retained earnings) would avoid the costs and opportunities for comparison or risk that building capital through external financing through debt or equity. This would enable BHP to leverage its cash reserves, which would be the most economical, least risky way to fund the investment using no external financing or given up ownership dilution.

BHP has a strong cash flow and a conservative debt policy so using internal reserves or a combination of debt and reserves is likely the most efficient method taking into account risk.

Exogenous shock and financial policyÂ

BHP’s financing policy should be adjusted to stabilize the operations that will impact on the finances of the organization.

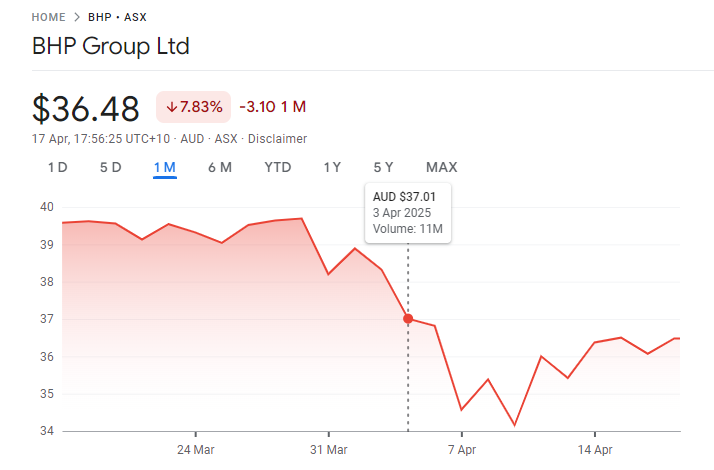

Figure 1Â Price of BHP (1 Day)

Source- Online through DatAnalysis (given)

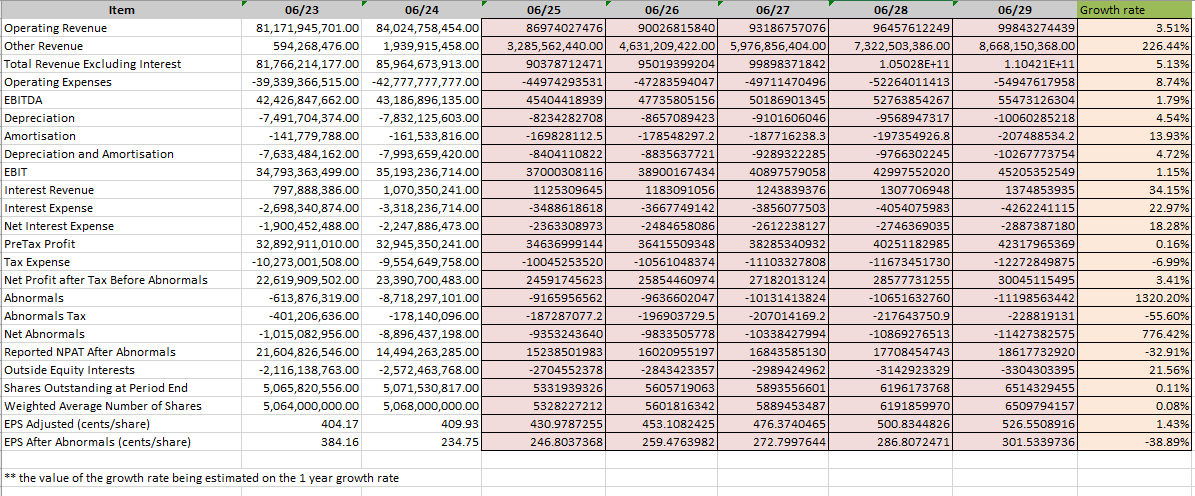

Figure 2 BHP Group Ltd. (I Month Prices)

There is sudden drastic decline in the price of the shares with the beginning of the previously announced auto tariffs that is on the 3 April 2025 (figure 2)

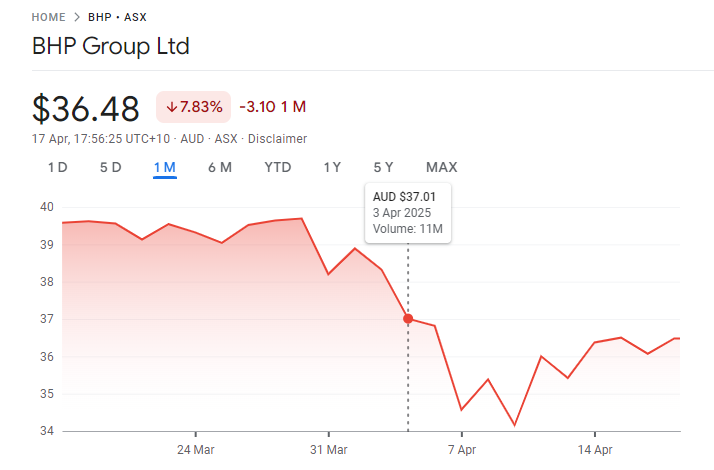

Figure 3Â BHP Price in 1 Year

Source- Online through link Marningstar, DatAnalysis (given)

Â

- Cost Management- On the decline in sales, BHP must also immediately focus on cost control. Also part of this would include deferring nonessential capital expenditures, renegotiating supplier contracts or streamlining operations to cut overhead costs. Efficiency measures should be implemented to provide off-setting profitability in the absence of revenue.

- Liquidity Preservation- Maintaining a strong liquidity position should be BHP’s priority. It might use any amount of cash on hand or access to available credit lines to plug any short-lived gaps in its cash flow as a result of the sales holiday. Furthermore, as companies face financial stress, BHP will need to avoid the temptation to increase debt unless very necessary, which would only further heighten financial stress.

- Debt and Equity Considerations- BHP should not explore the issue of new equity, as it will dilute ownership and may prove an expensive exercise in the volatile conditions. BHP would consider low cost debt options, or could attempt to renegotiate existing debt to reduce pressures on its finances, if further financing was needed (Sukmawardini and Ardiansari, 2018). Financing arrangement should be left with the firm flexible so that it cannot take on excessive risk and should be able to sustain the shock.

To summarize, BHP’s financing policy should restrict its financing to the internal liquidity and costs management to minimize unnecessary debt accumulation (Tamba et al., 2025).

Get Expert Help

ConclusionÂ

In the above report, there has been discussion about the BHP Group Limited's financial performance, growth projections, and debt policy combination indicates that, based on the BHP group performance the company is ready for any prevailing external issues which may hold the company back in its growth. Further, there is discussion about the company's long term prospects and its commitment to strategic investments in high growth sectors, copper and nickel, are its recent activities. Revenue and EBITDA are projected to grow steadily in the next five years. But BHP will have keep a careful eye on its debt levels, being aware that, alarmingly, external shocks like a 25% tariff could damage cash flows and threaten profitability. Considering we firmly believe it is less likely to successfully market equity than internal reserves, BHP needs to strengthen its financing strategy on internal reserves and low cost debt when needed. In the face of external shocks, the company should respond in priority to the management of the costs, liquidity preservation and the preservation of flexibility financial so able to respond to the changes in the market. Overall, BHP is in a strong position overall in terms of its financial foundation and strategic growth plans in this regard.

ReferencesÂ

Ahmad, S., Bakar, R. and Islam, A. (2020). The Effect of Debt Financing on Firm Value: A Panel Data Approach. ALBUKHARY SOCIAL BUSINESS JOURNAL, [online] 1. Available at: https://archiveasbj.aiu.edu.my/images/Vol1Issue2Dec2020/4.pdf.

Brealey, R.A., Myers, S.C. and Marcus, A.J. (2023). Fundamentals of corporate finance. thuvienso.hoasen.edu.vn. McGraw-Hill.

Hoggett, J., Medlin, J., Chalmers, K., Beattie, C., Hellmann, A. and Maxfield, J., (2024). Financial accounting. John Wiley & Sons.

Lee, T. A. (2020). Financial accounting theory. In The Routledge companion to accounting history (pp. 159-184). Routledge.

Maynard, J. (2017). Financial accounting, reporting, and analysis. Oxford University Press.

Nurdiansari, R., Sriwahyuni, A., Apriani, R. and Fadhilah, N.H.K. (2022). The Effect of Dividend Policy, Debt Policy, and Asset Growth on Firm Value with Managerial Ownership as Moderating Variables. [online] www.atlantis-press.com. doi: https://doi.org/10.2991/aebmr.k.220204.011.

Revsine, L., Collins, D.W. and Johnson, W.B. (2021). Financial reporting & analysis. thuvienso.hoasen.edu.vn. McGraw-Hill.

Schroeder, R.G., Clark, M.W. and Cathey, J.M., (2022). Financial accounting theory and analysis: text and cases. John Wiley & Sons.

Sukmawardini, D. and Ardiansari, A. (2018). The Influence of Institutional Ownership, Profitability, Liquidity, Dividend Policy, Debt Policy on Firm Value. Management Analysis Journal, [online] 7(2), pp.211–222. doi: https://doi.org/10.15294/maj.v7i2.24878.

Tamba, R.R., Tsamara Nayla Safitri, Panjaitan, G.O., Athaya, N.S. and Azzahra, A.S. (2025). The Impact of Debt Policy, Profitability, and Company Size on Firm Value. International Journal of Economic Research and Financial Accounting, [online] 3(2). doi: https://doi.org/10.55227/ijerfa.v3i2.260.

Vernimmen, P., Quiry, P. and Le Fur, Y., (2022). Corporate finance: theory and practice. John Wiley & Sons.

AppendicesÂ

Figure 4 Projected Balance sheet

** The figures have been estimated on the basis of the growth of the last 2024 from 2023

Figure 5Â Projected Income Statement

You May Also Like To Read:

Accounting and Financial Management

Creative Writing Techniques: A Complete Beginner’s GuideÂ

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies