In recent times, managers of business units lay a high level of emphasis on undertaking accounting tools and techniques for evaluating performance. Moreover, accounting tools enable managers to make evaluations of monetary aspects and take suitable decisions for the upcoming time period. In addition to this, investment appraisal tools also provide assistance to the manager in assessing whether the proposed investment will contribute to organizational success or not.The present report is based on the case situation of Triton Corporation which comes under the manufacturing sector. In this, the report will provide deeper insight into the manner through which managers of firms can take decisions about working capital investment and other matters pertaining to the operations. Further, the report also depicts the reasons due to which the company prefers to reduce the level of gearing. Along with this, the report also entails how financial ratios and budgetary control tools assist in identifying possible risk areas and give indications for improvements.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

A. Drafting report to managing director

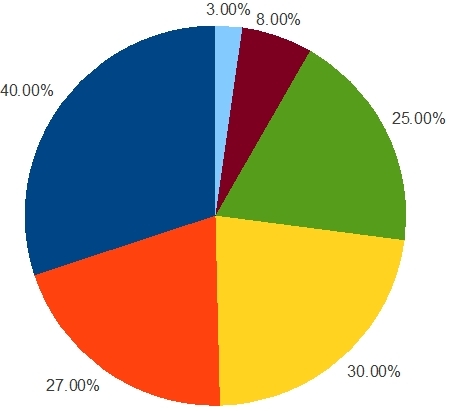

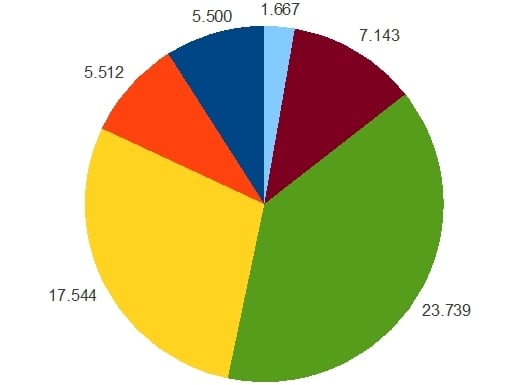

(a) Assessing each product divisions

While evaluating the divisions in light of competition which is growing day by day. The organization consists of six operating divisions such as electrical products, Floor Boards, Car Accessories, Industrial services, bathroom services and Pipes. In last year Triton Corporation is generating huge sales of all electrical products followed up by Industrial services (Weygandt, Kimmel and Kieso, 2015). For floor board cost of sales is in large proportion as compared to other six divisions profit. In the context of salaries and wages highest has been consumed by industrial services but it is generating profit not like pipes which is consuming seconding highest of wages but its market share is least along with profit (Cost Controlling techniques, 2018).

|

Divisions

|

Revenue |

Operating profit |

Operating profit margin

|

|

Electrical products

|

40 |

2.2 |

5.500

|

|

Floor boards

|

25.4 |

1.4 |

5.512

|

|

Car accessories

|

17.1 |

3 |

17.544

|

|

Industrial services

|

33.7 |

8 |

23.739

|

|

Bathroom Accessories

|

7 |

0.5 |

7.143

|

|

Pipes

|

6 |

0.1

|

1.667

|

- Electrical Products : Market share of electrical products is 40% during recession also because it is basic necessity of every organization and even for household as well. It is indirectly linked to sales which is highest of this division and even material cost is higher of this (Edmonds and et.al., 2016). The operating profit margin of these electrical products that is 5.5 which indicates the margin of Triton Corporation after paying all the variable cost such as salaries and wages, material etc. It is not so efficient, Triton Corporation is not able to control cost of this division. Huge working capital is required in this division.

- Floor boards : The market share is 27% but it is not able to be a major contribution of operating profit because of huge material cost, high salaries in other words Triton Corporation is not having capability to control its variable cost. Huge working capital is required in this division (Butler and Ghosh, 2015).

- Car Accessories : The sale of car accessories is not appropriate according to other division but due to less variable cost that is material cost, salaries and other is controllable by Triton Corporation so it is contributing huge proportion of 17.54 that is second highest in all divisions with great market share.

- Industrial services : The aspect of industrial services given the best example for operating profit margin, in which it has maintained sales instead of controlling its variable cost. In the proportion of sales and variable cost both are not equal so this leads to huge market share along with the highest operating profit margin (Epure, 2016).

- Bathroom accessories : It is the division which is less contributing in sales but while generating sales it is controlling its variable cost i.e. low salaries and wages leads to less market share but it is generating profit margin through operations is of 7.14 which is highest than electrical products and floor brands.

- Pipes : The division which consists of less sales, operating profit margin and even market share as well. As its sales are of 6 m but its variable cost is of 5.9, it clearly depicts that it is not even reaching to break even (Kim, Schmidgall and Damitio, 2017). The Triton Corporation has huge working capital requirement in this division.

(b) Implications of low value added items in context of financial returns and profitability

In the context of financial returns and profitability, the highest operating profit is of industrial services and followed up by car accessories but at average is of bathroom services (Ionescu, 2017). The Triton Corporation must track on sales of these accessories along with variable cost. According to operating profit margin most low value added services are considered as :

- Pipes with 1.67 operating margin

- Electrical products with 5.5 operating margin

- Floor Boards with 5.5 operating margin.

With the context of pipes, there is requirement of huge working capital so they should work on that. For basis of electrical products Triton Corporation must check on its material cost which should be controllable because this is directly linked to margin. Whether it is generating huge sales but they should implement some efficient techniques which will be controlling there cost. They should use techniques like EOQ analysis and all for controlling the variable cost. With the perspective of floor boards, sales is average but major proportion is used in material cost so similar to electrical products they should apply some techniques which will be effective for both divisions and even they should be promoted very well so this will lead to generate more sales and they should try to control the variable cost. The bathroom accessories are at average position (Bernardi and Collins, 2018), they should keep track of there sales by applying effective techniques for promoting and for best reach to consumers. Bathroom services are considered as most essentials for every human so they should use effective tools for promotions by satisfying there existing customer and to make new target group.

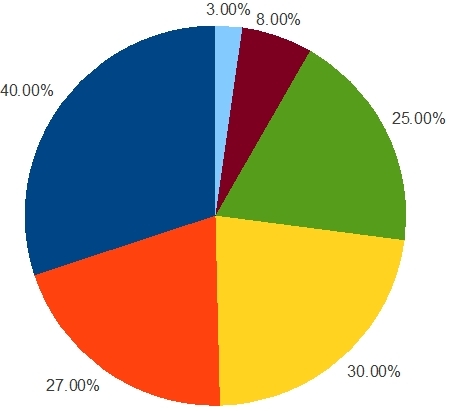

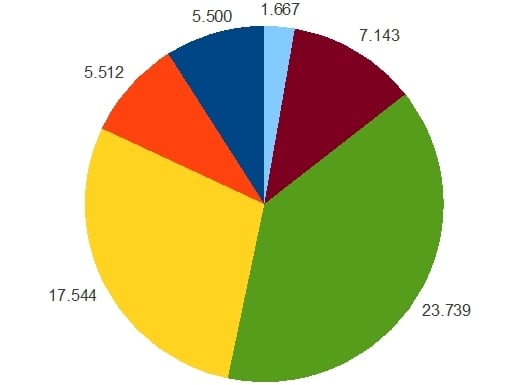

B. Critical analysis of arguments of selling bathroom division and pipes division

|

Bathroom accessories

|

Pipes

|

|

Sales

|

7

|

6

|

|

Variable cost

|

6.5

|

5.9

|

|

Operating profit

|

0.5

|

0.1

|

|

Operating profit margin

|

7.14

|

1.67

|

|

Market share

|

8

|

3

|

The present era is very competitive in nature as all the divisions of same Triton Corporation are competing with itself for revenue and profit margin. According to long term viability strategic decision has to be undertaken in context of Triton Corporation for both division such as bathroom accessories and Pipes. In the context of sales they are somewhat similar and both has huge requirement of huge working capital or capital expenditure for improving the level of efficiency (Yousefi, and et.al., 2018). Both the division can be sold of for making it more competitive by selling them. As there is need of more capital for generating more profit but in the same context market share of bathroom accessories is of 8 but division of pipe has very less market share. Bathroom accessories are very profitable in both purpose that is household and for corporates as well. Even, while observing the operating profit margin of this is 7.14 which is recommendable to the organization in all aspects. They should work on division of bathroom by controlling variable cost in proportion of sales.

For increasing sales they should use various promotional techniques such as advertising cost, satisfying existing customer which will lead to word of mouth. They can create strong online presence by creating blogs of there employees and quality team. There search engine optimisation should be attracted to various people such as creating great content and viral it through online. In the same series they might launch social media presence as it is interlinked to search engine optimization (Tyler and et.al., 2018). Even they can use social media such as Twitter and all. For increasing sale they might explore opportunities into new market overseas. There is requirement of extensive research for finding new potential.

In the same context for bathroom accessories it is contributing good in operating profit margin but for generating more margin it should be able to control variable cost such as material cost, Labour cost control and even it should be able to control the cost of overhead by various techniques. For controlling the cost of material they should try to get the best possible price and they must reduce or even eliminating cost. They might check with various suppliers and they should get best manufacturing material in best price (Dang, Hoang and Tran, 2017). The material should be purchased in specific quantity according to space of inventory, there should be not over inventory and it should not be very less. The inventory should be according to capital and waste should be controlled by tracing mistakes and forming strategies such as use of every piece of cloth, metal etc.

Even they can control variable cost by controlling labour cost and on contrary they should make there worker very efficient. There operations of each product must be tracked by senior management that from where it is coming and its expenditure (Weygandt, Kimmel and Kieso, 2015). Staffing arrangements must be observed according to scheduling of labour within specific duration. In same series variable overhead cost must be controlled which will lead to great contribution in the aspect of operating profit margin. Energy use must be audited and there should be proper use of machines and lights. Thus, division of Bathroom must not be sold because it will generate huge profit to the Triton Corporation but on contrary side, if it is sold then it will be improving the final margin of Triton Corporation at the end of year. Its variable cost to the Triton Corporation is of 6.5 but its operating profit margin is 7.11, so this will indirectly increase margin of Triton Corporation without incurring any variable cost.

The division of pipe is generating sales of 6 million with its variable cost of 5.9 which is clearly giving picture of less profit before interest and tax and after paying its tax and interest it will directly incur loss to the Triton Corporation. But this scene is hypothetical, the tax structure is not known. So according to operating profit margin it is giving 1.67 and its market share is of 3% which is very low as compared to other division (Edmonds and et.al., 2016). Division of pipe is not contributing too much and indirectly it is generating cost to Triton Corporation instead of generating profit. Accordance with its market share, if it is sold to the organization who is only dealing with pipes then it will not generate cost but it will be referred as margin to Triton. So it should concentrate on margin instead of cost.

C Reducing the financial gearing

In terms with analysis operational gains of Triton Corporation in due period there will be various techniques which are needed to be considered by business professionals such as reducing costs of assets. Similarly, the professionals are planning to improve the sum of capital for equipment replacement and modernisation programmes (Butler and Ghosh, 2015). Firm approaches towards reducing financial gearing in the due period which will be effective and helpful as per meeting financial goals. Requirement of financial capital in the operational activities are the main areas of concerning in a business unit. Therefore, there have been increment in debt securities which are by selling marketable securities among investors of firm. On the other side, they have also considered factors which increase profitability for all products which are being produces and marketed in environment. If comprised with analysing the activators which will be used on managing profitably of entity such as Payback period.

1. Identification of influential factors which will be used for building long term payback period:

For making appropriate project palliating and administration of the operations which will require suitable changes in the operations. Therefore, to improve the probability of the period which will be consideration by making effective changes in the operating in each activities. In Accordance with the electrical products of the firm in the due period they have made the highest revenue of 40 million (Epure, 2016). The costs incurred in production are for material it was 34.5, for salaries it was 1.2 and the other relevant costs are of 2.1. Therefore, in relation with such analysis it can be said that the firm is making fewer payments to the employees in the manufacturing the Electricity products. Considering the period of recession which insist that there will be fruitful changes in the operational practices of the firm which in turn will have effective revenue generation as well as profitable gains at the same time. The highest revenue rented by electric products of Triton Corporation which has the negative impacts as the salaries payable to the employees are lower than other product line of firm.

Concerning revenue generated by other departments of business such as floor boards, cars accessories etc. on which Pipes and Bathroom Accessories are having poor performance as they are contributing lower income gains to business. Thus, the highest salaries is being payable by the firm in industrial services in due period. Therefore, to concern the wealth of individual as well as firm it can be said that they have to balance the operations as well as pay employees as per their efficiencies and ability to operate activities (Kim, Schmidgall and Damitio, 2017). Thus, concerning the lower income retained by the other department on which it can be said that there is needed to have satisfactory improvements in sales as well as reduction in the costs. Moreover, it has been planned by Triton Corporation to make investments in operational activities of firm on which they will have effective rise in revenue and operations.

2. Strategies for reducing gearing:

Triton corporation can take major steps for reducing gearing and for improving debt to capital ratio. These strategies can be applied for raising the profitability of sales, restructuring the debt and for managing inventory in very efficient manner (Ionescu, 2017). It will be representing the total financial soundness of Tritorn corporation and even it will reveal appropriate proportion of equity and even for financing debts. In gearing, 0.5 is considered as ideal ratio or less than it. Any organization who is representing gearing 1 or more than that it is considered as insolvent technically.

One of the most common and logical way for reducing debt to capital ratio then it should be capable for raising sales revenue and profitability. This can be attained by increasing prices, sales or even by decreasing costs. The cash which is extra used for paying in context of existing debt. Gearing can be also reduced by managing inventory in most effective pattern. Unnecessary inventory should not be managed because it is blocking money or it is referred as waste of cash flow (Bernardi and Collins, 2018). The most logical way for raising capital is to restructuring debt and it will lead to decrease debt to capital ratio. If Triton Corporation will be financing at huge interest rate, and present interest rate is simultaneously lower so organization can attain refinance to its own existing debt at lower rates. So this will directly decrease the expenses of interest and monthly payments which leads for raising bottom line of Triton and cash flow.

D. Introduction of decentralization programme which will be beneficial and decision making

1. Advises to the managing directors:

On the basis of given case situation, Triton Corporation is planning to cut staff from 48 to 20. Given scenario presents that managing director believes effectual control can be exerted on financial aspects through using ratio and variance analysis technique (Yousefi, and et.al., 2018). In the context of Triton Corporation both such techniques are highly effectual which in turn gives clear indication in relation to undertaking strategic actions for improvement.

Ratio analysis may be served as the most effectual technique which assists in evaluating financial performance under different areas such as profitability, liquidity, solvency and efficiency. Hence, using the tool of ratio analysis Triton Corporation’s manager can evaluate financial performance over the years and compare the same with rivals (Tyler and et.al., 2018). Hence, by performing ratio analysis firm can assess its weak areas and thereby become able to take measure for performance enhancement. In the context of Triton Corporation, by taking into account final accounts following ratios have been calculated.

Liquidity ratio analysis

|

Particulars

|

Formula

|

Figures

|

|

Current assets

|

35

|

|

Current liabilities

|

20

|

|

Current ratio

|

Current assets / current liabilities

|

1.75:1

|

Interpretation: Outcome of ratio analysis presents that Triton Corporation has maintained enough current assets for meeting obligations. From assessment, it has identified that ideal current ratio accounts for 2:1. On the basis of this, firm must have 2 current assets for meeting 1 obligation. Hence, by taking into account overall evaluation it can be presented that business unit is able to meet obligations from current assets prominently.

Solvency ratio analysis

|

Particulars

|

Formula

|

Figures

|

|

Loan

|

48

|

|

Total shareholders’ equity (Share capital + reserves)

|

22

|

|

Debt-equity ratio

|

Loan / shareholder’s equity

|

2.18

|

Interpretation: Tabular presentation shows that debt-equity ratio implies for 2.2:1 respectively. In the context of Triton Corporation, solvency position can said to be sound when debt-equity ratio accounts for .5:1. It presents that firm should 2 equities over 1 debt. Currently, Triton Corporation has maintained high debt over equities which in turn considered as not a good indicator. The reason behind this, in the case of debt, firm has to make interest payment irrespective of profit generation. On the other side, under equities, firm offer dividend to the shareholders only when it generates enough margin during the concerned period. Hence, it can be mentioned that higher debt level imposes financial burden and impacts firm’s profitability. Thus, at the time of raising funds Triton Corporation should keep in mind ideal ratio such as .5:1.

2.Critical analysis over fruitful needs of management accounting techniques in business practices:

Impacts of managerial accounting techniques in business operations will be helpful as it creates the appropriate internal analysis over the operations. It consists of preparing all the reports such as income statements, financial statements, budgets as well as various accounts of the different operations incurred in the business (Dang, Hoang, and Tran, 2017). Moreover, the main motive of preparing such reports is that it will be a helpful tool that initiates the internal auditing of the venturi. Derived outcomes from the operations of the firm will have effective control over the business gains and profits of the entity. Budgeting and various costing used in management accounting methods benefits in organizing the operational activities. Thus, it provokes the managerial professionals as well as accounting personnel to undertake the research through financial of the firm as well as generate the new ideas which will have impacts on managing operations of entity (Weygandt, Kimmel and Kieso, 2015). Ideas and the decisions made by professionals are in relation to improving the operational activities as well as managing the profitable gains of the firm at the right time. Reduction in costs and expenses will be effective as it rises the operational gains as well as brings the better internal administration of the firm's operations.

Get similar Managerial Accounting Assignment Help for your assignments.

CONCLUSION

By summing up this report, it has been concluded that techniques of managerial accounting assist managers in identifying lower value-added products. Hence, by identifying lower value-added items managers of Triton Corporation would become able to take strategic decisions in relation to the same. Further, it can be summarized from the report that emphasis should be placed by Triton Corporation on the bathroom accessories division over others. Moreover, profit before interest and tax as well as market share is higher in the case of bathroom accessories division in against to pipes. Thus, by offering and selling bathroom accessories to the customer's Triton Corporation would become able to gain a competitive edge or position over others. It can be summarized from the evaluation that a high level of debt or gearing imposes a monetary burden in terms of interest payment and thereby affects profitability. Referring to the results of the financial ratio evaluation it can be depicted that the liquidity position of the firm is good.

REFERENCES

- Bernardi, R. A. and Collins, K. Z., 2018. Ranking Accounting Scholars Publishing AIS and Technology Research in Accounting Education. AIS Educator Journal. 13(1). pp.1-28.

- Butler, S. A. and Ghosh, D., 2015. Individual differences in managerial accounting judgments and decision making. The British Accounting Review. 47(1). pp.33-45.

- Dang, N. H., Hoang, T. V. H. and Tran, M. D., 2017. The Relationship Between Accounting Information in the Financial Statements and the Stock Returns of Listed Firms in Vietnam Stock Exchange. International Journal of Economics and Finance. 9(10). p.1.

- Edmonds, T. P. and et.al., 2016. Fundamental managerial accounting concepts. McGraw-Hill Education.

- Epure, M., 2016. Benchmarking for routines and organizational knowledge: a managerial accounting approach with performance feedback. Journal of Productivity Analysis. 46(1). pp.87-107.

You may also like to read:

D/508/0491 Corporate Social Responsibility In Oakman Inns

Lean Supply Chain Management

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies