Management accounting plays a vital role in the decision-making process by the firm's manager so, they can effectively able to operate function in most desired way. It is totally different from the financial accounting as they always look forward for the future due to which they can able to control functions (Ax, and Greve, , 2017). Thereafter, accountant apply its knowledge as well as skills to prepare management reports. It helps them to effectively formulate the policies and strategy within the organisation that directly impact on the future. The management reports is produced on weekly and monthly basis that shows the sales revenue, accounts payable, account receivable, variance analysis and other statistics. The assignment is based upon Pearson in which there is a discussion on the types of absorption and marginal costing techniques. Further, it also described the management accounting and how it varied from the financial accounting. There is also study on type of management accounting system and also discuss pros as well as cons. Furthermore, it also described the various type of budgets and its methods. There is a study on type of pricing strategies and various factor of demand and supply. There is an also identification of management accounting system that respond financial problems.

LO 1

1.1 Introduction to management Accounting

Accounting system can be defined as statistic data related to business records. It contain details about any firm which are recorded in the books are are necessary for operating the financial related operation like purchase, sales, etc. Accounting is necessary for firms are they are required for the analysis, maintaining and keeping financial information like transaction of the organization. Moreover, it provides the details about the financial status of firm. Accounting done to serve the specific demands of management is termed as management accounting (Bodie, 2013).

Management accounting cab be defined as the procedure in which managers and employees are supplied to the organization. Details regarding the allocating resources, decision making, evaluation, monitoring and rewarding the performance by relevant details about financial and non financial. For illustration, details about the expense of assemble department in operating department of any auto mobile plant is part of management accounting information. Details like measurement of consumer satisfactions, their loyalty, employee motivation, innovation, quality and timelines of the allocated process are terms which are included in non financial management accounting. Pearson management accounting system is required for management of employees, manager, and details related to the financial and non financial terms.

Comparison between the Management accounting and financial accounting.

Details in management accounting and financial accounting are almost similar which is related to the financial details along with various quantitative details related to business operation. The role and activities of manager is to plan, direct and control ( Chenhall, and Moers, 2015). the But there are certain differences which needs to be considered are mentioned below:

| Features |

Management Accounting |

Financial Accounting |

| Reports of User |

Internal: Manager and employees |

External: Creditors, regulators, stakeholders and shareholder |

| Report types and frequency |

Reports are frequently needed and is part of internal reports   |

Quarterly or annually and financial information are required. |

| Aim |

For making decision |

General purpose |

| Content  |

Business sub unit details

reports need to be in details.

Extended more than double entry and relevant for making decision. |

Used for decision making. More condensed or aggregated.

Limited to double entry and related to cost data which are mostly considered in accounting principles |

| Process of verification |

Survey by manager and no independent survey |

Survey through CP

|

For illustration:

Details about mentioning unit cost of manufacturing goods comes under Management accounting while total cost for the manufacturing products and its purchase by consumer comes under financial accounting.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Reason for integrating management accounting system.

Integrating management accounting system is performed in order to combine the standard financial details regarding financial accounting purpose. Details are needed for firm's success and to have the financial and non-financial details. The main framework for the integrating system consists of Pre-integration which includes the details about the training needed by management accounting, budget required for the employee development, organizing meeting, interviews with other staff members. The goals for integrating is combine the organisation and collaborating all the departments (Cooper, Ezzamel, and Qu, 2017). Building trust and understanding in employees along with providing motivation to them. Them comes the Integration planning which includes the details about the generating plans, identifying the firm performance, coordination, integration, allocating the roles and responsibilities, etc. for this phase the main goal is defining the integration goals, providing training staff, providing validate information and decision making process. All the details are used for making further action plan. Third comes the implementation option which includes providing training to the employees, integrating complete system. For this phase the main goal is to achieve the speed in integration and adequacy in newly generated system. At last, all the details and process of implementation are send for review and evaluation in order to get feedback and options which requires changes.

1.2 Range of management Accounting Techniques.

Various types of Management accounting system are defined as follow:

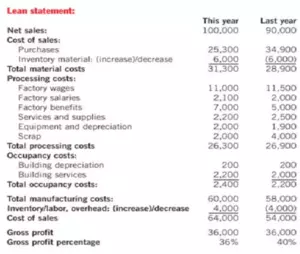

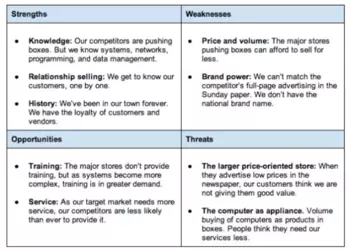

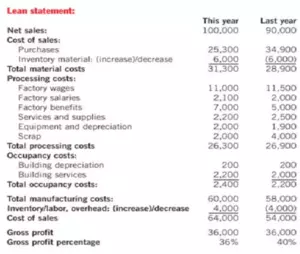

Lean accounting:

The cost analysis in the system is done in real time. In this accounting, the structure and definition are provided in starting. It is used for reviewing the benefits and cost of value chain which provides the accurate image of cost and product to the customer. They are used for the large production of the product. In asset the product capacity is considered and inventory is considered to be waste but if they are found more (inventory) they must be stored, maintained and monitored. In Pearson, this is used to record the data base related to number of publication made in that particular year.

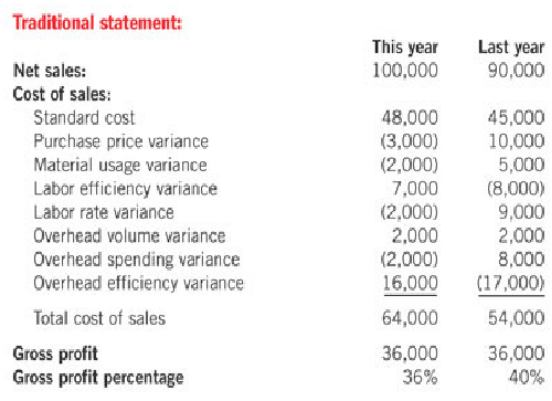

Traditional Accounting:

Traditional accounting can be defined as the productive capacity is considered as the idle production lines ( Figge, and Hahn, 2013). In assets, inventory is considered. Moreover, it contain the details which are needed for the large interval of time. Traditional accounting focuses on the cost of product sold.

Throughput Accounting:

Mostly used in the management accounting. It is recognized for recording the data related to interdependence of modern product procedure. Throughput accounting is to measure the contribution /Â Unit of constrained resources. It provides the details for decision which provide the supportive details about enterprise profitability improvement to managers. It is considered to be new management accounting.

Illustrattion : 1 Learn Accounting

Illustration 2: Traditional Accounting

Advantages of various types of management accounting systems: there are various advantages of MAS in accounting. Manager and business owner can create their own management accounting of their business operations, management and information. MAS helps in reducing the operational expenses of the company like Pearson. These are used by organization in order to review their cost of economic resources and other operational sources. Improves the cash flow or maintaining the budget of the company. They also supports in making the business decision which are required for the business development of the company. Moreover, it increases the financial returns of the company. For this accountants needed to prepare the data base related to consumer demand, sales in that month and issues raised in economic marketplace by change in consumer price.

1.3 Presenting financial information

Methods used in presenting the financial information should be in proper format and in more meaning full methods and should fulfill the purpose ( Fullerton, Kennedy and Widener,2012). It must be in simple language and must be easily understood by any person. There is no prescribed form for sole proprietary and partnership concerns. Following is the horizontal form of representing the financial information.

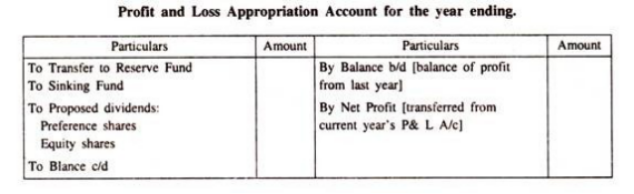

In horizontal forms which includes the detail about the profit and loss account, balance sheet.

Illustration 3: Vertical form of balance sheet

Balance sheet: As per the order of the government, companies are permitted to prepare the detail of balance sheet in any of one way horizontal or vertical form. Vertical part is shown below.

Integral part of the balance sheet is accounting policy and explanatory details. Also, footnote must be provided at the end of balance sheet which should show the liabilities.

Illustration 4: Horizontal form of balance sheet

Income statement:

It contains details about the income statement which consider the profit an loss account of company. T shape is taken for preparation. Heading provided is profit and loss. Profit and loss are taken in appropriation account along with net profit is shown after preparing the taxation provision. Previous data is also mentioned.

Moreover it includes the details like:

1.Details about the balance sheet and income statement.

2.If financial-statements are prepared by income statement then balance sheet must also be included.

3. Details about the cash-flow statements must be shown during the year.

4.Statements must also contain details from stockholder.

5.Financial-statements should be written at last.

- Various types of Managerial accounting reports supports the organization owner and manager in order to monitor firm performance and should be prepared for the uncertainties. Details are considered according to time sensitivity.

- Budget making: Used for performance analysis of company and department along with control costs.

- Accounting Receivable Aging: Used for maintaining cash flow for firms which provide credits to consumers. It is periodically maintained.

- Job Cost Reports: Shows details regarding specific project. Used for job profitability by the company and for estimating money (Fullerton, Kennedy, and Widener,2014).

- Inventory and management: Used by organization to make process manufacturing more efficient. Manager used to provide the bonus to department which performed best.

LO 2

2.1 Microeconomic Techniques

Cost Analysis, Cost variances and how to apply marginal costing and absorption costing

Identification of different types of cost:-

It is that type of cost which sacrifice resources to get benefits. For examples, sacrifice material, labour wages, electricity, car production and deprecation. Pearson classifies the cost that are described as follows:-

Product cost are that type of cost incurred from the production of goods and these are mainly involves a direct labor, factory wages, direct material, factory depreciation and factory wages etc. It can further categorise into:-

Direct materials:-

It is that type of cost that are assigned directly from the goods at reasonable cost. It can cost of printing newspaper etc.

Direct labour:-

It represents labour cost that shows time spent on a particular good. For example labour cost assigned on an oil ring that are spent through petroleum engineer.

Production overhead:-

It is that type of which represents all manufactured cost rather than direct material and direct labour. For example, electricity, fuel etc ( Hiebl, 2014 ).

Prime cost

It is that type of cost which is summing up all types of direct cost that are mainly involves direct material and direct labour etc. It is transfer of raw material into the final goods and it is a sum of production overhead, direct material and direct labour.

Fixed and Variable cost

Fixed cost can be define as that expenses that cannot be changed over a some specific time period at some level of activity. Whereas, variable cost can be define as there is a change in the level of output that involves such as direct labour and direct material etc.

Cost varianceÂ

It is a difference among planned amount and actual amount of cost. Thus, if the actual expenses are more than budgeted amount than it is a favourable cost variance. Therefore, if the actual expenses are less than the planned budgeted than it is unfavourable cost variance.

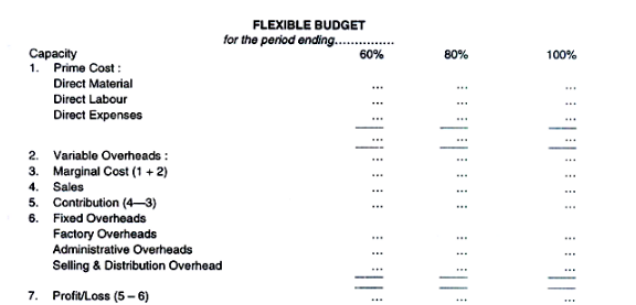

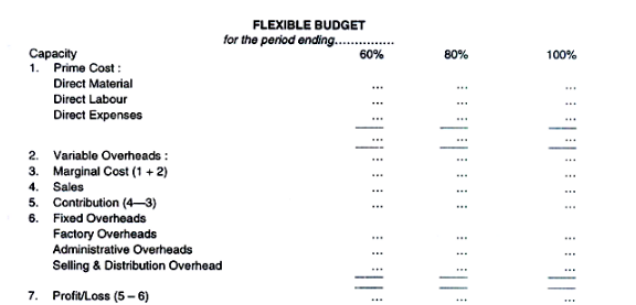

Flexible budget techniques

Flexible budget can be define as there is a change in the level of output for a certain time period. Pearson adopted techniques to prepared flexible budget that are described as follows:-

1.Tabular method:-

It is that type of method in which the budget is made for various level of output. The expenses that are categorised into fixed cost, variable cost and semi-variable expenses. It can be prepared in tabular form that shows each level of activity in a horizontal columns and budgeted figure are shown in vertical column ( Kaplan, and Atkinson, 2015).

can be define as there is a change in the level of output that involves such as direct labour and direct material etc.

Cost variance

It is a difference among planned amount and actual amount of cost. Thus, if the actual expenses are more than budgeted amount than it is a favourable cost variance. Therefore, if the actual expenses are less than the planned budgeted than it is unfavourable cost variance.

Flexible budget techniques

Flexible budget can be define as there is a change in the level of output for a certain time period. Pearson adopted techniques to prepared flexible budget that are described as follows:-

1.Tabular method:-

It is that type of method in which the budget is made for various level of output. The expenses that are categorised into fixed cost, variable cost and semi-variable expenses. It can be prepared in tabular form that shows each level of activity in a horizontal columns and budgeted figure are shown in vertical column ( Kaplan, and Atkinson, 2015).

2.Charting method:-

It is that type of method in which expenses it to be estimated for various type of level of activity through categorised into semi-variable, fixed and variable expenses. The expenses that are estimated which is plotted on graph on Y-axis and in the X-axis plotted a level of activity.

3.Ratio method:-

It is that type of method in which it determines a variable cost per unit and the flexible budget is made for normal expected level of activity.

Benefits of fixed budget techniques

There is no requirement to adjusting budget for each month:- It is that type of budget in which the budget is fixed for each month or year to year. Therefore, to plan a fixed budget there will be a needed to make plan for annual cost and develop a strong emergency fund.

Easy to track:-

The benefits from fixed budgets is that the amount not vary from each month so, it is easier to prepared budgets and track ( Luft, 2016Â ).

Management costing techniques

Marginal costing:-

It is that type of costing in which there is an incremental or decremental of costing when extra unit is produced.

Absorption costing:-

It is that type of budget of that consider both fixed and variable expenses are fixed and variable.

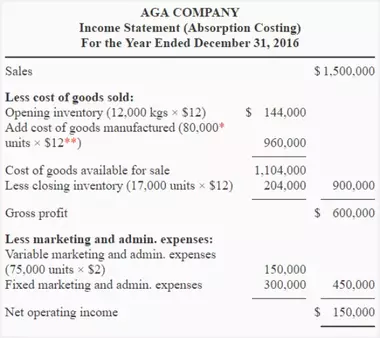

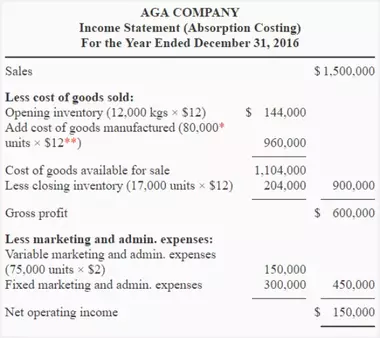

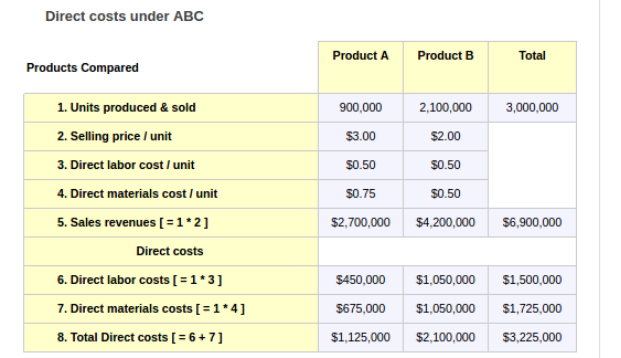

The Pearson company prepared income statement by adopting absorption and marginal costing method. From this there is a difference in the net profit of a company due to variation of cost in both techniques. These are discussed as follows:-

Interpretation: From the above table and figures there is a difference in the net profit of absorption costing techniques that is 150000 and marginal costing 13000. The main reason for this is that in the marginal costing only fixed expenses are taken and in the absorption costing both variable and fixed expenses are taken into consideration.

2.2 Product costing

Introduce product costing and how to apply different costing in financial statements

Pearson company adopts product costing method as they play a vital role in the management accounting system. It is an equal sum of direct labour cost, production overhead expenses and direct material etc. It helps the company to predict the price of a product through determining actual cost of goods. It can be define as an internal material cost value and it is a actual cost that are used to make comparison with the standard cost. For this, they can make an effective decisions by the management accountant.

2.3 Cost of Inventory

Inventory can be defined as goods that are needed for the eventual sale by organization. In simple words it's the stock of product which is manufactured by the company I order to sale and components which are required for making them. Its a form of linkage between production and sales of goods. Cost of holding inventory means there are certain cost which company needs for the consideration in account while planning for inventories.

Company inventories are defined as

Beginning inventory+ Net purchase- cost of goods sold= Ending inventory

Different types of inventories:

1 Direct Inventories:

Plays important part in production and for finished product. Further they are classified in four types:

I.Raw materials : These are physical resources which are used in manufacturing goods. Includes the natural and can be easily found in nature. e.g. tomatoes for making sauce. The main motive is to have continuous supply of the raw product ( Messner, and et.al., 2016).

II.Semi-finished Goods: Product which are not 100% complete. There are steps which remain before the final product. For manufacturing furniture, may purchase the raw furniture and design can be obtained before selling.

III. Finished Goods: Product which are ready for the distribution. For illustration, sweaters,shawls comes under final products.

IV. Spare parts: parts which are required when actual part is not working. Every industry     consists of spare parts in the company. Its makes the process smooth and uninterrupted.

2.Indirect Inventories: Indirect inventories are those items which are necessary for manufacture but are do not become the part of final product. This may include the electricity used or other such products. They are used in many factories, companies and organization.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Main inventory valuation methods of LIFO, FIFO and AVCO.

- FIFO (First in First out): It means that the product which are made first must be sold first.\

- Last-in, Last-out This means that product which are manufactured at last, in inventory they are sold first.

- Average cost: In this weight-age average of the availability units are taken for the sale at the time of accounting and after which it uses those details for the average cost for determinant of the values related to COGS and ending inventory.

LO 3

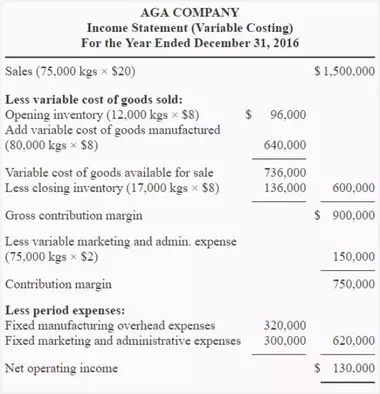

3.1 Use of budget for planning and control

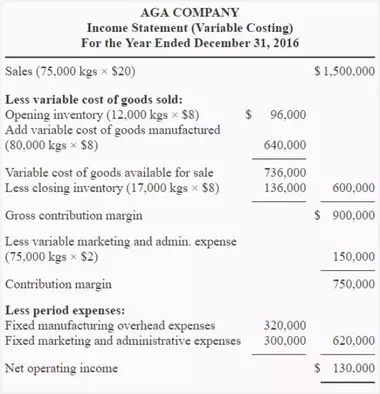

Budget for planning and control is very necessary. Planning is required by the organization in order to make the plans regarding the future action, revenues and money which need to be invested. This also includes the uncertainty related to product. Control is necessary for as it provide the feedback which is required for developing planning, and for the measurement of deviations from plans and principles. After which making the actual plan for the company progress. Planning and control process for making the budget supports the management to plan the use resources, including human resource, to achieve company's objectives and to maintain the resources utilization to achieve objectives (  Modell, 2014).

Illustration 6: Planning and control process and budget

Types of budgeting for organization: budget is made in order to maintain the cash flow and maintain the use of resources. The are various ways of making the maximizing the assets and revenue. Most common used Budget are mentioned below:

Master Budget:

It is the organization used individual budget made for the making complete analysis of the company in terms of financial activity and health. It includes the details like assets, income statement, operating expenses, sales and other related things which are necessary by the company achieving target. This is also required to evaluate the complete performance of the company. They have larger budget which are known as Master budget for larger companies .

Operating Budget:

Used for the forecast and analyzing the details related to the income projected and expenses over the period of time. It concludes the details about the administrative expenses labor costs, materials costs, manufacturing costs, overhead, production, and sales. They are created periodically.

Cash Flow Budget:

it means projecting how and when the cash is received by the company and when expenditure are made during the period of time. For the company it is required for the maintaining the cash. Accounts payable and accounts receivable are the factors which comes under it.

Financial Budget:

Company's strategies are prepared under this budgeting for managing the cash flow, revenue, income statement, and expense. This are required for the financial health of the organisation.

Static Budgeting:Â

Fixed budget which is made by organisation. They remain unchanged whether there are changes in the other things like revenue and sales (Otley, and Emmanuel, 2013 ).

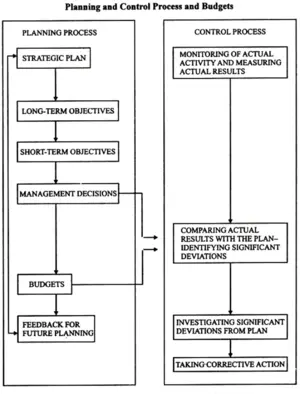

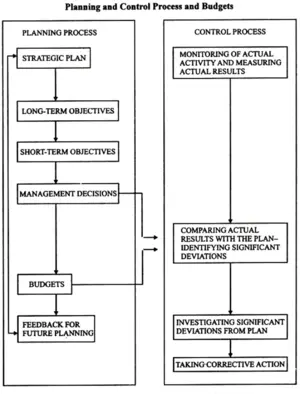

3.2 Activity based costing

It is that type of method to assign cost of each product or service, task and projects that are based upon the resource used for each activities. It is a totally differ from the traditional costing method in which both gross margin and cost of goods sold are totally different from each other. It helps the management to make decisions that which product gives profit and loss when it sells into the target market. There are various benefits of ABC techniques as it give information of cost of each product in most accurate manner. It also shows that it also identify that the true profitability and cost of each goods or services.

Introducing various pricing methods and strategies

The method which helps to the Pearson company in order to calculate and derive price of products and services is called pricing technique. There are different number of the strategies of pricing are available which are introduced as below:

4.Cost plus pricing: The technique of pricing in which at the initially total cost of production is to be assessed is identified as cost plus pricing. After making calculation of the total cost of every product desired level of profit is to be included in that and whatever comes is considered as price of the product.

5.Penetration pricing: In this technique at the very initially or introduction phase of the firm price of products of Pearson will be lower to attract more customers. As it grows in the industry of operating it starts to charge the high amount of the prices from consumers.

6.Marginal pricing method: At this pricing technique there is only variable costs are used and considered for taking decisions of price of the goods and services.

7.Value added pricing: The pricing strategy under which only quality of product, brand of firm etc. are included in the total cost is called as value added (Tucker,and D. Lowe, 2014).

3.3 Elements of supply as well as demand

Supply and demand both are the aspects which helps to the company Pearson in order to analyse level of selling price of the services provided by it. In the market if there are demand of Pearson services enhance and supply reduce then selling price increase. In opposite to this, in case the demand of services offered by it reduces along with supply declines then in this case it needs to reduce the selling price of it. To determine the price of services of Pearson to sale there are some factors are also considered along with the supply and demand which are such as follows:

- Testes as well as preferences of the users of the services of the company.

- Demand of the customers of services of Pearson lead to make changes in the supply.

- Level of economic condition or income of the people.

- Price of the products as well as services along with the related goods.

- Number of the customers available in market for using services of Pearson.

- Expectations of the consumers in relating to the pricier

Introducing various pricing methods and strategies

- The method which helps to the Pearson company in order to calculate and derive price of products and services is called pricing technique. There are different number of the strategies of pricing are available which are introduced as below:

- Cost plus pricing: The technique of pricing in which at the initially total cost of production is to be assessed is identified as cost plus pricing. After making calculation of the total cost of every product desired level of profit is to be included in that and whatever comes is considered as price of the product (Renz, 2016Â Â ).

- Penetration pricing: In this technique at the very initially or introduction phase of the firm price of products of Pearson will be lower to attract more customers. As it grows in the industry of operating it starts to charge the high amount of the prices from consumers.

- Marginal pricing method: At this pricing technique there is only variable costs are used and considered for taking decisions of price of the goods and services.

- Value added pricing: The pricing strategy under which only quality of product, brand of firm etc. are included in the total cost is called as value added.

3.4 Common Costing System

Various types of costing system depends on the product type and the services provided along with the organisation principles and policies which must be taken after the consideration of the cost of complete system. This also include the cost of particular task and processing. Moreover, it includes the marginal cost and absorption cost after which costing are been set up. In terms of Costing system, the main purpose of making the cost must be mentioned. Various types of costing system are:

1.Process Costing: this is applied to the places where the product produced re identical and are taken together. It consists of regular process which may consist of various stages. The output of the product completely depends on the input of the product. The cost completes depends on the number of process and number of stages.

2.Job costing : This is considered where job are different and are preformed as per the consumer specification. It includes the direct cost of material and labour. The price may depends on the product produced and the labour work required for it. In terms of costing, it comes under the Absorption which includes the complete pricing of business.

3.Marginal costing : the output of the product can be increased but not increasing the input price and they output remain the same. Increment in the variable cost per unit is considered as marginal cost. The cost is based on cost per unit in which fixed cost is not included at any stage is known as marginal cost (Shields, 2015 ).

4.Absorption cost: it includes the cost of production during the end product and services. It covers the sales revenue.

5.Activity based Costing : it is based on the setting the allocation criteria in advance, the cost is never gained back, as there is always differences in budget forecast of sales and cost and the final result .

3.5 Strategic planning

Illustration 7: Basic strategies of planning

Strategical planning is done in order to maintain the activity of the organization that are used as the priorities, focus, operational strength, employee and stakeholder ensure, in order to achieve the targets.

For starting and managing the business there are certain factors required that helps in making strategic planning. These are: Â

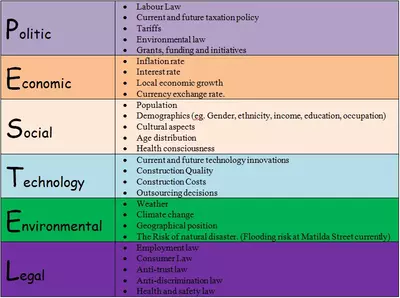

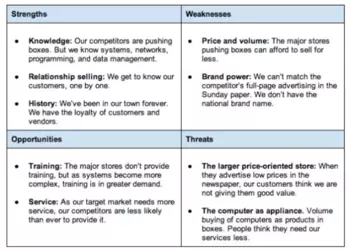

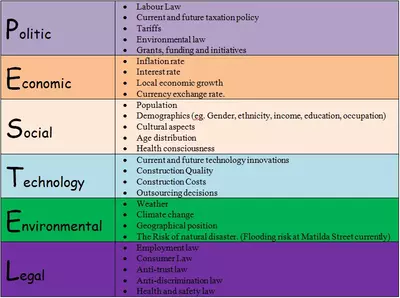

Market Research,Cost based, SWOT analysis, Poster Five models

Illustration 8: SWOT analysis

Illustration 9: Pestle analysis

LO 4

4.1 Management Accountant Set Of Skills

Skills required for a management accountant

In the Pearson business entity when there is management accountant provide its services in the finance and account department then some specific kind of skills and highly needed. Moreover, such skills are such as follows:

- Effectual communication skills which covers both aspects like as oral as well as written.

- Capability to do work in individual as well as along with the overall team.

- Highly analytical skills are also required for making the business decisions and improve financial performance and health of Pearson within industry.

- Depth knowledge of accounting theories, standards etc. for making accounting treatments in the books of account.

- Ability to complete the numerical aspects as it is necessary part of the accounting.ng level for the future.

Financial problems

How management accountant responds financial problems

Pearson is working well in the industry for improving its performance it is essential for the cited firm to identify its financial problems and to resolve them on time. That can help the organization in gaining competitive advantage and by this way profit of the entity can get increased. There are several ways through which financial problems can be identified and management accounting can respond to the economic issues. These are described as below:

Ratio analyses:

It is the great tool and company's operational performance and financial success can be measured with this tool. These are such as profitability, liquidity, solvency ratios etc. By looking at the profitability ratio Pearson can identify the loop fall in the system and can improve it by making good strategies. Liquidity ratios show that whether company is able to repay the outstanding on time or not. If liquidity position of the organization is not good then it cited firm can identify the problem and can take immediate action to improve it.

Capital budgeting:

It is another method that helps in addressing the financial problem to the Pearson company. Pay back period, Accounting rate of return, net present values are essential tools that supports the cited firm in knowing the most profitable investment and company can resolve its financial problems by investing in good projects. That can help in minimizing the issue of failure and Pearson will be able to enhance its profit significantly ( Simons, 2013 ).

Variance analysis:

It is the tool that compare the actual and estimated results. If actual outcome is differed from the estimated results then Pearson can get to know about the loop fall and can take immediate action to resolve it. By this way issues related to high cost, ineffective control etc can be resolved soon.

4.2 Finance governance

Finance governance and how it responding financial problems

Financial governance is the tool of evaluation technique that helps the entity in identifying the real performance of the organization and by this way company can make sensible decisions to achieve the goal of the company. Financial government can help the organization in predicting and preventing the financial problems to great extent. One of the great technique of monitoring the financial performance of the Pearson company is use of balance score card. It is the tool that supports the cited firm in identifying the issues which are currently faced by the cited firm. In this process manager of the Pearson identifies the needs of consumers and according to this modify its learning products. It helps the cited firm in knowing the gap between existing requirements and what is currently delivered by the entity. By this way organization can make strategy and can implement these strategies in the workplace in order to resolve the financial problems. Because by this way cited firm will be able to satisfy the needs of the target audience and it will attract more customers towards the brand (Soin, and Collier, 2013).

Internal business practices are looked by the manager under this process. They try to identify the loop fall and take such initiatives through which it productivity can be enhanced Balance score card helped the Pearson company in making control over the business operations. By this way gap between actual and expected performance of the company will be reduce

Conclusion

Summarizing the whole report it has been concluded that Management accounting plays a vital role in the decision-making process by the firm's manager so, they can effectively able to operate function in most desired way. It is totally different from the financial accounting as they always look forward for the future due to which they can able to control functions. It has been also analysed further, Pearson company adopts product costing method as they play a vital role in the management accounting system. It is an equal sum of direct labour cost, production overhead expenses and direct material etc. It helps the company to predict the price of a product through determining actual cost of goods.

References

- Ax, C. and Greve, J., 2017. Adoption of management accounting innovations: Organizational culture compatibility and perceived outcomes. Management Accounting Research, 34, pp. 59-74.

- Bodie, Z., 2013. Investments. McGraw-Hill.

- Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management accounting and its integration into management control. Accounting, Organizations and Society, 47, pp. 1-13.

- Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research.

- Figge, F. and Hahn, T., 2013. Value drivers of corporate eco-efficiency: Management accounting information for the efficient use of environmental resources. Management Accounting Research, 24(4). pp. 387-400.

- Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2013. Management accounting and control practices in a lean manufacturing environment. Accounting, Organizations and Society, 38(1). pp. 50-71.

- Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2014. Lean manufacturing and firm performance: The incremental contribution of lean management accounting practices. Journal of Operations Management, 32(7). pp. 414-428.

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies