The role of accounting has increases with the increasing demands of the existing business entity in relation to the external market for Assignment Help. The higher complexities will enhance the accounting needs to record all kinds of transactions in the business properly. The accountant will ensure the cost reduction by managing its existing financial resources. Nero ltd has been selected for this project report who is responsible for reducing the obligations of the management by nurturing its present skills and capabilities. This project report is all about defining various principles and the importance of management accounting tools. The different tools are effectively explained in order to apply in a business to gain competitive advantage. The higher preference is given to the absorption and the marginal costing methods.

SECTION 1

1. Importance of management accounting in improving performance of the company

Nero Ltd has focuses on various aspects of their organization which will play an integral role in improving the performance of the business entity. The business entity has emphasises on two major factors such as financial and non-financial matters of the organization which is given below:

Financial aspects

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Cost-

The management accounting principles are used by an entity in order to improve their existing working conditions. The primary concern of management is to identify its costs in relation to the sales and the revenue (Diánez-González and Camelo-Ordaz, 2016). The management accounting will help in crafting cost reduction strategies to reduces cost which in turn increases revenue of Nero Ltd.

Financial risk-

ratio analysis is the tool of the management accounting which is used to assess the financial performance of an entity. The future potential risks are identified by applying various tools and techniques such as profitability, liquidity, efficiency and financial ratios by analyzing its financial statements. This will help in internally audit of all the organizations to avoid the external threat imposed by the rivals.

Revenue-

Budgeting is the important tool used by an entity in order to forecast its future sales and the revenue in relation to the existing facts and figures in improving their existing performance. The sales budget prepared in advance will help in generating future market trends and further risks created in the same market.

Non-financial aspects

Quality-

The management accountant who are appointed to eliminate the existing costs incurred by the business entity in order to reduce its existing market obligations. The application of total quality management will be beneficial for the business in identifying the areas in a business require further improvement will be rectified in advance to remove the causes in present.

Time- The timely delivery of goods and services will help the business to gain the trust and loyalty among the variety of customers (McLaughlin, 2016). The management accounting technique will be applied to reduce the time of business operations and its further delivery to seek customers loyalty. The automation techniques has applied which checks the supporting resources involved in the business operations in reducing its overall time.

Service-

The providing of various products or services is essential in order to maintain the brand image in the eyes of several customers (Sami, 2016). The service can-be improved by focuses on the errors and deficient areas of a business which are creating barriers in the delivery of good amount of services. The management accountant will estimate the total costs incurred by the business on all the areas which further help an entity owner to curtail unnecessary expenses.

2. Explain different kinds of management accounting systems

Business report

It is one of the important tool used in the business of Nero Ltd who uses this kind of management accounting tool whose major focus is on assessing the cost incurred by the business (Stacchezzini, Melloni and Lai, 2016). The owner has prepared current time log project sheet in which time are allotted to each and every report are considered in relation to the future business projects. The owner will conduct internal and external analysis report which provides accurate data regarding existing business performance. The projects are prioritized on the basis of time, competition, external market trends. The time consumed by the employee in allotted project are compared in relation to the standards set by an individual over the years.

The status report prepared by an individual in order to ensure the proper functioning of the project currently operated in an organization. The reports are prepared which cover all the above information to be reviewed by the head of the project organizations.

Sales and expenses report

The handling of cost are the major concern of the top management who intended to reduce their obligations by using different tools and techniques (Nishimura, 2016). The sales enhancement is the major outcome of every business while conducting their business operation with higher pace. The expenses are managed by keeping control over them by setting threshold limit of expenditure in the business organizations. The Forecasting of sales will be conducted in relation to the number of customers held in the organization who will raises the level of sales and the revenue in this business entity.

3. Evaluate the benefits of management accounting systems

There are various management accounting system reports which are explained by defining its merits and demerits in relation to the management of Nero Ltd which is given below:

Business reports

The management accountant of Nero Ltd prepare various frameworks in order to match its requirements with the internal and external needs and the expectations of the business. The current business report has emphasises on two different aspects that is internal and external analysis of the existing business entity (MartÃnez-Ferrero, Banerjee and GarcÃa-Sánchez, 2016). The internal analysis will be based on the current skills and capabilities of all the employees are used as direct weapon against the external rivals. The external party's impact has reduces by nurturing the capabilities of the entity. The comparative analysis will be conducted in which the past projects are compared with the existing projects in terms of various key considerations.

Status reports

These kinds of reports are prepared to assess the effectiveness and efficiency of the existing business projects taken by the business ion a particular year (McLaughlin, 2016). This report has also act as one of the legal and accurate evidences that showcases that which projects are completed by the business in year. The customer satisfaction can be increase by working upon the weaknesses of an entity by identifying material misstatements in the statements. The comparison can be done on the basis of these kinds of reports which is used as standard guidelines which enhances the values of the business. The employee responsible for handling the project will provide reasons for the short-coming or achieving the goals that offers specialization to an entity as compared to its competitors.

Sales and expenses report

The management accountant held responsible for meeting all kinds of expenses by preparing separate budget for different kinds of expenses (Sami, 2016). The different expenses budget will produce good results in order to compensate the effect of external expenses on the revenue earned by an entity. The expenses will be restricted in the business by reducing its quantity which gradually reduces its impact in the near future. The current expectations of an entity is to meet the obligations of the society on the corporation to raises the level of profits. The higher profit will bring higher satisfaction level among the customers and shareholders as they get more returns in exchange of the amount invested by them.

4. a) Preparation of income statement on absorption and marginal

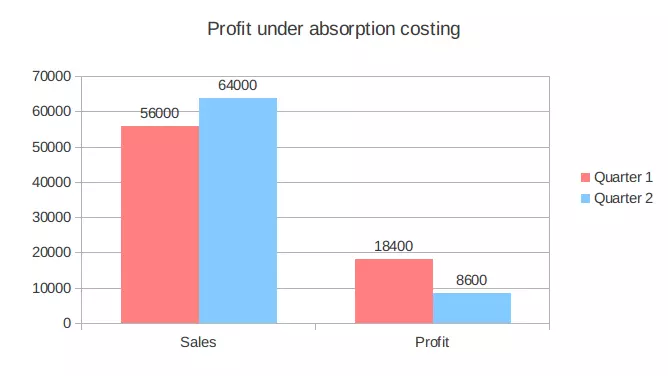

Absorption costing is one of the tool used efficiently in the presentment of information accurately in the management accounting tools. The current approach is widely used in evaluating the value of inventory held in the business for long time in the business (McLaughlin, 2016). This method will consider all kinds of cost taken into account such as fixed and variable cost in assessing the true figure of sales and the revenue. In the above case scenario, the Nero Ltd has degenerate loss in the initial quarter and later on it shifted to the earning of profit. In this situation the company has produces 4000 fewer units as compared with the standard sales units of 60000. The under absorption of units will create burden for an entity as the expenses will become higher in relation to the existing sales and the revenue generated by an entity

Table 2: Income statement under marginal costing

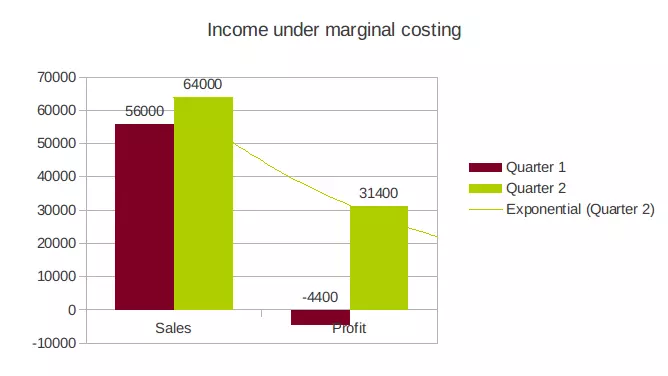

Marginal cost is also recognized with another name that is the variable costing which emphasises on the variable costing in producing the sales and profit in the particular year (Uyar and Gungormus, 2016). The situations of the business is not favorable in initial quarter as it showing loss in the first quarter. The entity has generated higher amount of profit as it is over absorbed its sales units in comparison to the budgeted output. The existing facts and figures are not strong enough to meet the requirements of the business in relation to the sales achieved by an enterprise in a particular quarter.

Table 3: Calculation of unit cost

b) Explain the differences in profit under two methods

The differences in the profit occurred due to the changes takes places in their overall treatment of considering all kinds of records (Wu, Chen and Lee, 2016). The treatment of absorption costing a marginal costing will create effect on the changes in the generation of profit. The inventory level will determine generation of profit over the quarters in this business of Nero Ltd. The increase or decrease in the level of inventory will affect the profit earned by an entity in a year. The profit will be increases in the absorption costing when the level of inventory will increase over the period.

The marginal costing has opposite effect in the profit generation but the treatment of the information is totally based on the inventory (Bloomfield, Nelson and Soltes, 2016). The generation of profit will be higher when the inventory will be decreases over the year. In the case scenario of Nero Ltd, the inventories are decreases from 12000 in initial quarter to the 4000 in next quarter. The reduction of the inventory will bring higher amount of profit over the years.

c) Reconciliation statement of profit or loss

The reconciliation statements has prepared in the internal business management of Nero Ltd in which costs are ascertained in advance in relation to the sales and the revenue generated by an entity (McLaughlin, 2016). The entity will be able to produce good amount of results by recording each and every information in the single statements. The reconciliation of profit statements has been prepared in the business entity to ensure the accuracy of all facts and figures. The effectiveness of the accounts are judged by measuring the performance of an entity in relation with the existing facts and figures (Stacchezzini, Melloni and Lai, 2016). The comparison can be done among the various accounts which will help in considering the external matters in relation with the external entity. The generated profit can be relied by the business as it is cross checked at every stage of the process. The business can be managed properly in order to impose effective control on their existing entity in order to produce good results. The standards are created well in the business concern whose primary aim is to ensure the capabilities of all the employees who held responsible for achieving the desired aims and the targets of an entity.

SECTION 2

PART A

A budget is a forecast of what is expected to happen in future

It is correct that budget is the forecast of the things that may likely happened in the future (MartÃnez-Ferrero, Banerjee and GarcÃa-Sánchez, 2016). It is very important make forecast about future time period. This is because business past and future performance are interfaced in relation to proper management and use of resources. If, forecast will not be made about future then redundant use of resources will be made in the business. This will heavily put negative impact on the firm cash flows. Thus, budget is prepared by the business firm and estimation about likely business conditions are made and accordingly projections are made and optimum utilization of resources is done in the business. There are many techniques of the forecast that can be used to project values for the budget (Sami, 2016). Normally, business environment is analyzed by the managers because cash inflow and outflow depends on the conditions that business firm will face in the upcoming time period. If condition will favorable for the business firm then sales will increase and expense values will be enhanced or vice versa. Thus, it is very important to make estimation about the likely changes that may takes place in the business conditions.

Tools and methods can also be used by the firm to make relevant predictions. It can be said that there is great importance of the budgeting for the firms. By preparing a budget effective utilization of cash and other resources can be made by the business firms (Gow, Larcker and Reiss, 2016). For instance managers predict that sales will inclined downwards then in order to prevent redundant use of cash in the business firm can plan to buy less amount of inventory. By preparing such kind of plan blockage of cash in unused inventory of raw materials can be prevented. Cash can be used elsewhere in the business which will lead to profit maximization in the business. For the next year huge amount of cash can be generated by the business firm.

Compare and contrast three planning tools in management accounting

The three management accounting planning tools that are usually used by the business firms are break even, variance analysis and ratio analysis (Nishimura, 2016). All these three tools are used for different purpose and none of them can be undermine in terms of their significance for the managers. Break even analysis is used to compute the minimum number of units that firm needs to sale in order to cover entire cost of production. Contrary to this, variance analysis reflects the areas where extravagance is made and require improvement (Rikhardsson and Dull, 2016). Ratio analysis is used by the managers to evaluate firm from various sides. On comparison of these tools it can be said that there is significant importance of all these three methods. Break even analysis is the one of the most important effective tool for the managers because by using same number of units that is necessary to sale in the market is determined. In terms of earning of target profit number of units that must be sold can be determined on the basis of results of break even analysis. Variance analysis clearly reflects areas where extra money is spent. By taking action in relevant area overuse of money is controlled and saved (Rumens, 2016). Saved amount is invested in the business which enhance firm profitability. Ratio analysis is also effective because it helps managers in making comparison of the business firm on yearly basis in varied areas. Thus, areas where firm give poor performance can be easily identified by the managers. By preparing and implementing suitable strategy weak domain can be made strong. Thus, in this way all these three methods are effective for the business firm.

PART B

Compare effectiveness of management accounting systems in dealing with financial problems

The management accounting principles and various tools and techniques are applied in a business in relation to the prevention and detection of financial risks faced by an entity in a particular year which is mentioned as below:

Ratio analysis:

Ratio analysis is the one of the most important tool that help business firm in dealing with the financial problems (Knights and Tinker, 2016). In the mentioned technique varied sort of ratios can be computed like current ratio, debt equity and profitability ratios. On the basis of results of the mentioned ratios areas where firm is facing financial problem can be identified by the managers easily. Current ratio value is low then it means that firm have less liquidity in its business. This means that company will not be able to pay its short term liability in specific duration. Such kind of situation reflects that firm condition is critical and it needs to improve its performance. By preparing suitable cash management strategy blockage of cash in inventory can be prevented and financial problem can be removed from the business to great extent. Thus, it can be said that management accounting is effective and help firm in removing financial problem from the business.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Capital budgeting:

Capital budgeting is the one of the most important method that is used to measure the viability of the project (Chmelik, Musteen and Ahsan, 2016). In the capital budgeting method first of all projections of cash flows are prepared. Projections are prepared in respect to revenue and expenses in terms of raw material and other items that can be made in the business. It is the management accounting records that help managers in making estimation about cash flows that can occur in respect to the project. On the basis of these record's estimation about fund requirement is made. Managers determine whether they will be able to arrange required amount of finance for the proposed project. Thus, chances of occurrence of the financial problem is eliminated at preliminary stage in respect to the project (Herremans and Nazari, 2016). It is clear that management accounting tools are effective in preventing financial problems in the business organization.

Conclusion

It can be summarized from the above project report that an entity are required to make several decisions into business to enhance the current quality of the resources. The above report has focuses on the qualitative aspects of the management accounting that leads an entity towards the improvement of financial aspects of an organization. The budgeting has focused that enhances the current skills and resources utilized by the business in a given time frame decided by the corporation.

Rferences

- Bloomfield, R., Nelson, M. W. and Soltes, E., 2016. Gathering Data for Archival, Field, Survey, and Experimental Accounting Research. Journal of Accounting Research. 54(2). pp.341-395.

- Chmelik, E., Musteen, M. and Ahsan, M., 2016. Measures of Performance in the Context of International Social Ventures: An Exploratory Study. Journal of Social Entrepreneurship. 7(1). pp.74-100.

- Diánez-González, J. P. and Camelo-Ordaz, C., 2016. How management team composition affects academic spin-offs’ entrepreneurial orientation: the mediating role of conflict. The Journal of Technology Transfer. 41(3). pp.530-557.

- Gow, I. D., Larcker, D. F. and Reiss, P.C., 2016. Causal inference in accounting research. Journal of Accounting Research. 54(2). pp.477-523.

- Herremans, I. M. and Nazari, J. A., 2016. Sustainability Reporting Driving Forces and Management Control Systems. Journal of Management Accounting Research.

You may also like to read: Hospitality Management Unit 13: Conference and Banqueting Management

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies