Business accounting essentially means systematically recording, classifying, and summarizing financial transactions and events for preparing useful financial reports of a concern. These reports are generally used by business owners, investors, creditors and regulators to make well informed and appropriate decisions. In other words, business accounting is the fundamental design that businesses use to measure their financial activities and market performance. The major function of this report is to synthesize a comprehensive understanding of financial theories and practices in business financial and management accounting and at the same time clarifies the fundamentals and role of accounting (Abdulshakour, 2020). For students or professionals seeking support with complex financial topics, expert Accounting assignment help can provide valuable guidance and clarity. Besides, this report shall note the filing of the UK based financial statements and the balance sheet for the RD Plc with the supplied trial balance for the financial period 2024. It will also study the business capital investment appraisal for the newly introduced printer and provide insights on how to improve the business.

Source: https://okcredit.in/blog/how-to-set-up-business-accounting-system

MAIN BODYÂ

Hurry! Grades Are Waiting

Task 1:(a) Performance of Statement of Finances

This is what is commonly referred to as an earnings statement giving a company’s time frame wide scope of its financial results, often being a year or a quarter as set by (ATUKALP 20 RD Plc’s performance during the year 2024 is displayed in the table below:

Table 1:Statement of Financial Performance of RD Plc as at 31 March, 2024

|

Particulars

|

Debit (£)

|

Credit (£)

|

|

Total Profits

|

|

1,800,000

|

|

Opening Record

|

322,000

|

|

|

Purchases Made

|

947,000

|

|

|

Total Cost of Goods Available for Sale

|

1,269,000

|

|

|

Closing Inventory

|

|

300,000

|

|

Cost of Goods Sold

|

969,000

|

|

|

Gross Profit

|

|

831,000

|

|

Operating Incidentals

|

|

|

|

Rates & Insurance (49,000 + 5,000 - 7,000)

|

47,000

|

|

|

Distribution Costs

|

40,000

|

|

|

Salaries (155,000 + 9,000)

|

164,000

|

|

|

Utility Expenses

|

88,000

|

|

|

Audit Fees

|

38,000

|

|

|

Bad Debt Provision

|

14,000

|

|

|

Directors’ Compensation

|

66,000

|

|

|

Selling & Marketing Expenses (34,000 + 8,000)

|

42,000

|

|

|

Depreciation on Equipment (25% of £180,000)

|

45,000

|

|

|

Depreciation on Vehicles (20% of (£320,000 - £30,000))

|

58,000

|

|

|

Total Operating Expenses

|

602,000

|

|

|

Operating Profit

|

|

229,000

|

|

Finance Charges

|

|

|

|

Debenture Interest

|

15,000

|

|

|

Long-Term Bank Loan Attention

|

7,000

|

|

|

Total Finance Costs

|

22,000

|

|

|

Profit Before Tax

|

|

207,000

|

|

Tax Expenses

|

|

48,000

|

|

Net Profit After Tax

|

|

159,000

|

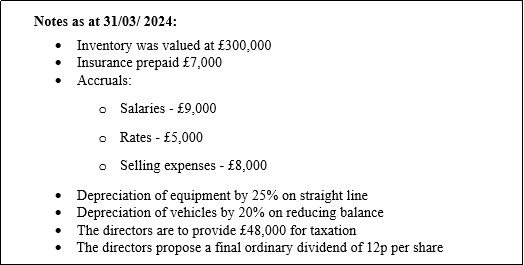

Working Note:Â

- Cost of Sales value:Opening stock plus purchases minus closing stock value.

£3220 00 + £947000 - £300000 = £969,000

- Operating Expenses

- Rates Insurance: £49,000 - £7,000 (prepaid) + £5,000 (accrual) = £47,000.

- Salaries: £155,000 + £9,000 (accrual) = £164,000.

- Selling Expenditure: £34000 + £8000 (accrued) = £42,000.

- Depreciation:The cost of equipment’s is 25% straight-line (£45,000), and 20% reducing balance (£58,000) machines, which totals £103,000.

A balance sheet is yet another name for the financial statement of the financial position of a firm, which reports the financial affairs of the firm at a specific time. The following is the statement of financial positions report from RD Plc for the year 2024 and which details the final financial position of the company at the end of that year.

Table 2: SOFP of RD Plc as at ending of 2024

| Assets |

Amount (£) |

| Non-Current Assets |

|

| Land at Original Cost |

800000.000 |

| Equipment at Purchase Price |

180000.000 |

| Accumulated Depreciation on Gear (40,000 + 45,000) |

-85000.000 |

| Net Book Value of Equipment |

95000.000 |

| Vehicles at Purchase Price |

320000.000 |

| Accumulated Depreciation on Vehicles (30,000 + 58,000) |

-88000.000 |

| Net Book Value of Vehicles |

232000.000 |

| Total Non-Current Assets |

1127000.000 |

| Current Assets |

|

| Inventory |

300000.000 |

| Trade Receivables |

80000.000 |

| Prepaid Insurance Premiums |

7000.000 |

| Cash and Cash Equals |

24000.000 |

| Total Current Assets |

411000.000 |

| Total Properties |

1538000.000 |

| Equity and Liabilities |

|

| Shareholder Equity |

|

| £1 Ordinary Share Capital |

720000.000 |

| Retained Earnings (189,000 + 159,000 - 40,000 - 86,400) |

221600.000 |

| Total Equity |

941600.000 |

| Non-Current Liabilities |

|

| 10% Debentures |

260000.000 |

| 8% Long-Term Bank Loan |

120000.000 |

| Total Non-Current Liabilities |

380000.000 |

| Current Liabilities |

|

| Accounts Payable |

55000.000 |

| Bank Overdraft |

5000.000 |

| Accrued Incomes |

9000.000 |

| Accrued Rates |

5000.000 |

| Accrued Selling Expenses |

8000.000 |

| Taxes Billed |

48000.000 |

| Final Dividend Payable (720,000 shares * £0.12) |

86400.000 |

| Total Current Liabilities |

216400.000 |

| Total Equity as well as Liabilities |

1538000.000 |

Working Note:

- Retained Profits: Balance Beg + Net Profit – Interim Dividend – Proposed Dividend<<

- £189,000 + £159,000 - £40,000 - £86,400 = £221,600

- Proposed Dividend: Share Price × Shares Number

- 12p × 720,000 = £864,00

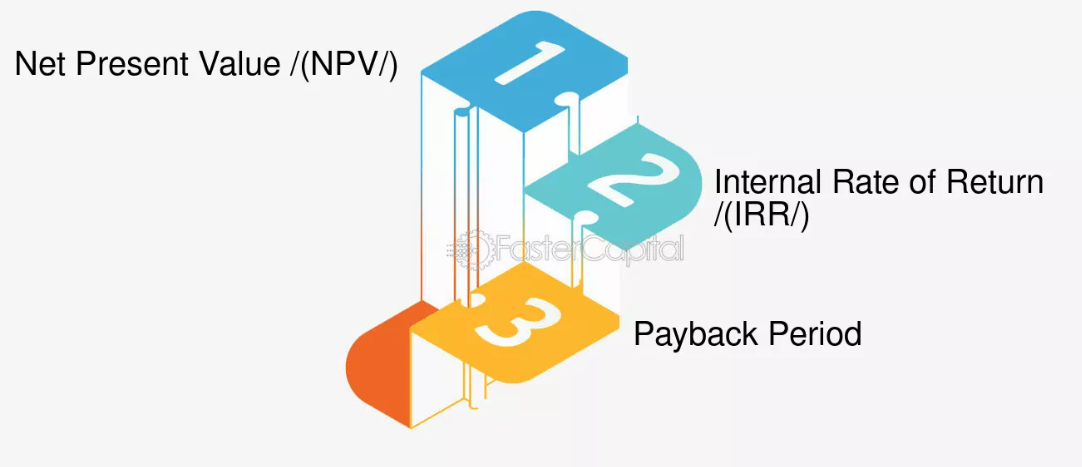

Task 2: (a) Assessment

Investment appraisal in business refers to evaluation of the profitability and financial viability of business-oriented investments (ATUKALP, 2023). From such an analysis, the firm measures the value of the investment through consideration of projected returns, costs and attendant risks. This process employs a wide variety of numerical and non-numerical methods of rating the potential and viability of business investments (Zhang, 2021)

Source-Â https://fastercapital.com/topics/npv,-irr,-and-payback-period.html

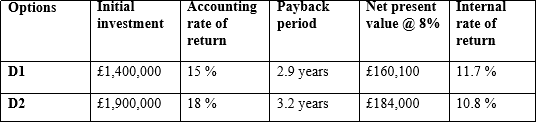

By using time to recover money invested, one easily evaluates the profitability of these payments by stressing the recovery on the principal investments. A fast arithmetic in the business world is easily understood and applied by anyone. It presents how fast the resources are available to compensate for the early expenditures contributing to the need for risk assessment, and short-term financial stability (Atrill and McLaney, 2018). The fact that the payback period excludes the time value leads to the fact that it does not consider the reduced value of the future cash over the cash received at the first. After the initial cost has been eliminated, the technique is irrelevant with regards to further cash flows from the project. Organizations should at first do a payback analysis in order to have a clear picture of a project before making complete decisions on its value. Business project D1 at RD Plc pays back after 2.9 years, a period that is much higher than D2’s of 3.2 years, thereby implying (Carter, Onyeador and Lewis, 2020).

- Accounting Rate of Return (ARR)

Taking ARR enables companies to estimate easily the returns they generate over their investments. Anybody who is supposed to have a finance background should be able to understand how ARR can be calculated easily. Year-to-year yield is very convenient as an indicator of profitability for different investment opportunities (Tkach, 2023). Compared to other techniques that are based on projected cash flow figures and heavily weighted towards accounting profits, the annual rate of return is easier to figure out and comprehend because it centers in on a single percentage figure. With an annual rate of return of 0.18% in RD Plc, Additionally, D2’s annual return of 0.15% indicates negligible improvement in profit, being equivalent to 0.18% average yearly profit for every 1% invested. Consequently, it seems that D1 reports a higher rate of annual return compared to D2 with the latter suggesting that D1 could be marginally profitable when measured using the metric (Dai et al., 2022).

Making use of the NPV analysis is thought to be a powerful asset for investment ratings on a financial basis, though subject to limits. However, the primary advantage of the method is that it can describe and explain the business potential profit of this project, while taking into account the importance of time value of money according to properly assessed cash flows and discount rate. Net present value is fairly simple in computation and is almost always easy to understand. It offered the company a deep level of insight on the value of a project by aggregating all financial events on the project during the entire life of the project into the project’s overall value (Refiay, Azher Subhi Abdulhussein and Shaikh, 2022). This approach is informative for investment analysis, simple, and readily applicable for determining a project’s worth, but importance of its limitations and the intricacies of other techniques, combined with qualitative factors, cannot be ignored. The net present value for RD’s plc’s D1 is £160100 while for D2 it is £184000 meaning that project D2 is more attractive since its net present value is £184 The higher an NPV the more favorable and profitable the investment. A D2 NPV has a higher potential to make it more profitable and provide a return compared with D1 (Kebriyaii et al., 2021).

- Internal Rate of Return (IRR)

The internal rate of return forms a basis for judging profitability of a project or an investment by means of a discount indicator that brings the NPV of the project to the level of zero. The internal rate of return offers each of these investments with a common percentage which makes them easier to compare in terms of their profitability. This method translates future cash flows into current value, thus allowing investors to compare profitability more effectively on a continuing level. Further, such method can be used to evaluate and rank various investment prospects. However, there is no better way to measure an investment that this tool can provide, but for the RD Plc a 11.7% internal rate of return for D1 and 10.8% for D2 show that they may be suitable for moderate and a marginally riskier investment respectively (Lokesh D et al., 2024).

Writing Academic Documents Seems Challenging ? Get Top-Notch Assignment Help at Your Fingertips!

Hire For Success ![cursor]()

Task 2 (b): Recommendation

According to the analysis of the data, critical indicators, such as NPV and IRR, suggest that Option D2 should be preferred to Option D1 even though one needs to make a higher initial investment for D2. Under an 8% discount rate, D2’s NPV is at £184,000 compared to £160,100 for D1 implying more superior expected present value for D2. The returns of D1 are even lower than those of D2, while the D2 IRR is over 8% discount rate – it implies that this is a suitable investment opportunity. other option Although the payback period for D2 is slightly longer than for D1, the latter is of greater interest than the investment performance in terms of the NPV and IRR. Thus, D2 should be chosen because it provides a greater NPV and IRR than the alternatives and therefore it be the more profitable investment alternative (Michelon, Lunkes and Bornia, 2020).

Task 2 (c): Analysis of IRR

Application of IRR enables the finance director to determine whether each project will achieve the target IRR i.e. at least 8% or not and the discount NPV results in positive outcomes for both D1 and D2. If NPV exceeds the mark of zero then project and investment will yield profit, where IRR establishes the discount rate where NPV is equal to zero, usually higher than those used to calculate NPV. And since D1 as well as D2 IRR is below 8% but have positive NPVs at 8% discount, it shows that these investment alternatives are likely to yield revenue and support the company’s profitability (Olayinka, 2022).Â

Order Now

CONCLUSIONÂ

In turn, all together, efficient business accounting practices are very important for informed decision making, strategic planning, achieving financial goals, and efficient company resources management. The large part of this report was devoted to the evaluation of the financial state of the UK-based RD Plc using the preparation of Income Statement and Balance Statement based on the provided trial balance sheet. This report also examines the introduction of two printers, and based on the information on option D2, this investment is preferable even though the D1 provides higher accounting rate of return and shorter payback period, but lower net present value and internal rate of return. From this analysis, choice D2 is the preferred choice, with the highest returns, quickest payback period and highest net present value although it has slightly higher initial cost.

REFERENCES

Abdulshakour, S. (2020). Impact of financial statements for financial decision-making. Open Science Journal, [online] 5(2). doi: https://doi.org/10.23954/osj.v5i2.2260.

Atrill, D.P. and McLaney, E. (2018). Accounting and Finance for Non-Specialists 11th edition. Harlow, United Kingdom: Pearson Education Limited.

ATUKALP, E. (2023). The effect of financial statements on financial review results. Statement of financial position or income statement. Gazi Journal of Economics and Business, 9(1). doi: https://doi.org/10.30855/gjeb.2023.9.1.006.

Carter, E.R., Onyeador, I.N. and Lewis, N.A. (2020). Developing & Delivering Effective anti-bias training: Challenges & Recommendations. Behavioral Science & Policy, 6(1), pp.57–70. doi: https://doi.org/10.1177/237946152000600106.

Dai, H., Li, N., Wang, Y. and Zhao, X. (2022). The Analysis of Three Main Investment Criteria: NPV IRR and Payback Period. [online] Advances in Economics, Business and Management Research. doi: https://doi.org/10.2991/aebmr.k.220307.028.

Kebriyaii, O., Heidari, A., Khalilzadeh, M., Antucheviciene, J. and Pavlovskis, M. (2021). Application of Three Metaheuristic Algorithms to Time-Cost-Quality Trade-Off Project Scheduling Problem for Construction Projects Considering Time Value of Money. Symmetry, 13(12), p.2402. doi: https://doi.org/10.3390/sym13122402.

Lokesh D, Aravind Vasan G, Vani V and Karthik N (2024). Stock Recommendation System for Better Investment Plan. [online] pp.1–6. doi: https://doi.org/10.1109/iconscept61884.2024.10627901.

Michelon, P. de S., Lunkes, R.J. and Bornia, A.C. (2020). Capital budgeting: a systematic review of the literature. Production, [online] 30(2). doi: https://doi.org/10.1590/0103-6513.20190020.

Olayinka, A.A. (2022). Financial Statement Analysis as a Tool for Investment Decisions and Assessment of Companies’ Performance. International Journal of Financial, Accounting, and Management, 4(1), pp.49–66. doi: https://doi.org/10.35912/ijfam.v4i1.852.

Refiay, A., Azher Subhi Abdulhussein and Shaikh, A. (2022). The Impact of Financial Accounting in Decision Making Processes in Business. International Journal of Professional Business Review: Int. J. Prof.Bus. Rev., [online] 7(4), p.7. doi: https://dialnet.unirioja.es/descarga/articulo/8955753.pdf.  Â

Tkach, L. (2023). Alternative investments influence on portfolio profitability. [online] Uj.edu.pl. Available at: https://ruj.uj.edu.pl/entities/publication/9c051314-5d41-4127-9597-18261fddd9e8  [Accessed 12 May 2025].

Zhang, S. (2021). Comparison of Different Investment Decisions Linked with Discount Rate. [online] www.atlantis-press.com. doi: https://doi.org/10.2991/assehr.k.211209.340.Â

APPENDIXÂ

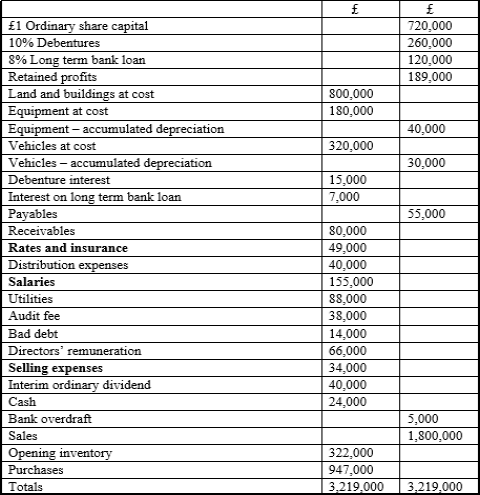

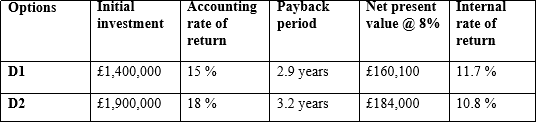

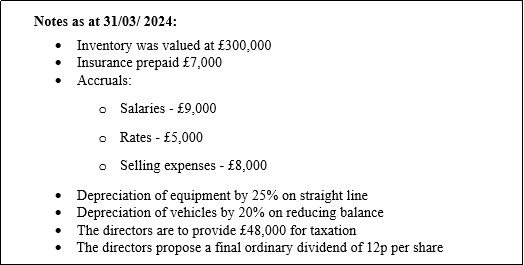

RD Plc Trial Balance as at 31 March 2024

RD Plc Investment Appraisal (Printer)

You May Also Like To Read:

for Decision Making- Level 4

Nestlé Southeast Asia Hub Strategy – Business Assignment Help

Persuasive Techniques: Mastering the Art of Influencing

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies