Business economics is specific area of economics that uses economic principles and numerical techniques to examine enterprises and variables that contribute to the heterogeneity of corporate structures including business connections with employees, capital and consumer markets. Business economics is important component of mainstream economics and this is an enhancement of actual business conditions of economic theories (Biondi and Zambon, 2013). It is a computational mathematics in the context of business's decision-making method and management future forecasting. This study covers various aspects of macroeconomic and microeconomic like price-elasticity of demand, supply and demand etc.

Part A – Micro Economics

1. Price Elasticity of Demand:

Price elasticity of demand refers to economical measurement of fluctuations in product's demand or purchase with relation to fluctuation in product's price. In formula equation it is shown as:

Price Elasticity of Demand = % Change in Quantity Demanded / % Change in Price

Economists utilize price-elasticity to explain how supplies or demands changes due to price fluctuations to recognize real economy performance. If product's requested quantity experiences a substantial shift in reaction to price movements, it is called "elastic," i.e. quantity extended far beyond its preceding level. If bought quantity has a slight shift in reaction to its value, it is called "inelastic;" or quantities has not extended dramatically from its preceding level. The principle of demand elasticity is very important in deciding prices of different production variables. Production variables are compensated as per demand elasticity. if a determinant's demand is inelastic, its value will be strong as well as its price would be lower when it is elastic. Once a distributor or supplier recognizes the Market Elasticity of Demand for their product, when they have to adjust price of product, this can enable them assess their increase in Net revenue. Overall revenue is number of items that are purchased multiplied by the price at which they are sold.

2. Main determinants of the price elasticity of demand for the Apple iPhone:

Relationships between price and demand of a product depends on different factors. These factors impacts product's demand directly and indirectly. Consideration of these factors is crucial to determine the overall impact on price's elasticity of product's demand. Their impacts on demand may be major or minor as per company's brand value, position in industry, customer group and nature of business. As Apple also has several factors which are playing key role in curve of price-elasticity of demand. Following are three main determinant's of Apple iPhones' price elasticity of demand, as follows:

Demand of Substitute Products:

The most significant variable affecting the demand elasticity is availability of alternatives or substitute products. The higher substitutes leads to more flexible market generally. Currently apple has several substitute products like one plus's smartphone, Samsung smartphone etc. Company's products are facing heavy competition in market due to these substitute products. However due to unique band image Apple's products are no so much affected by this factor but this factor forced company to bring changes in products and these substitutes attracts price sensitive customers.      Â

Share of non-price sensitive customer in market:Â Â Â Â Â

Another  determinant is proportion of non-price sensitive customers in any market as  most of iPhone's customers belong to this category. These are customers who are ready to pay any price for company's premium product range. This customer group wants quality products with unique features. Company product are generally designed while focusing on this customer group and well known brand at international level. Company always creates records of sales on first day of launching of iPhones. Company's demand is highly depends upon this customer group as they are also company's loyal customers.    Â

Time and Change in customer's preferences:

This crucial determinant which can affect price-elasticity of demand because with change in customer's preferences they may shift to another product which ultimately impact product's demand. Time taken by customers to change their preferences is significant determinant which determines Apple's product sales during a specific period. Company also spends lot of money towards research and survey of changes in customers' preferences so that company can launch products accordingly. Â Â Â Â Â

3. Apple benefit in terms of revenue from reducing prices:

Case 1:Â Â iPhone 11Price: Â $700 than sales goes to 10 million units.

Case 2:  iPhone 11Price changed to: $525 then sales goes to  14 million units.

Price Elasticity of Demand = Â Change (%) in Quantity Demanded / Change (%) in Price

= 40 % / 33.33 % = 1.2 %

As the company's price-elasticity of demand of product iPhone 11 is positive i.e. 1.2% so company get benefited in terms of revenue from declining prices.

Workings:

Change (%) in Quantity Demanded = (14 Million – 10 Million) / 10 million * 100 = 40%

Change (%) in Price = ( $700 - $525 ) / $525 = 33.33%

4. Perfect market competition-model:

Main characteristic of gaming industry is lower barrier on entrance and exist for companies. This industry is also closely linked with Apple's main product so it will provide competitive advantages to company. In Gaming industry company will face Monopolistic Competition. It implies to industry where many corporation are offering products/services which  are similar in nature but can not be recognized as perfect substitutes.  Barriers related to entries and exits in monopolistic-competitive industry are very low and also decisions taken by any company don't directly impacts its core competitors. This kind of competition is mainly concerned with brand differentiation strategy.

Looking for Free Tools to Ease Your Academic Writing Stress? CLICK HERE!

Monopolistic Competition also linked with Perfect market competition-model relies on principle that same products purchased by a huge no. of customers are generated by a number of companies. This is market model based on the idea that a large number of companies manufacture the same products purchased by a large number of purchasers. As in case of Apple, gaming industry all companies are designing games and providing gaming services and large no. of customers are using different games designed by these companies. So companies in this market is very low and decision of any competitor will not affect Apple's product demand. Â Â

5. Apple’s re-branding strategy:

Re-branding is a strategy that creates a new brand name, logo, design, idea or variation of it for existing brand with the aim of building a new, distinct image in minds of customers, shareholders, competitors as well as different stakeholders. This often includes radical revisions to logo, title, legal titles, logo, business model, and patterns of ads for a product.

PART B – Micro Economics

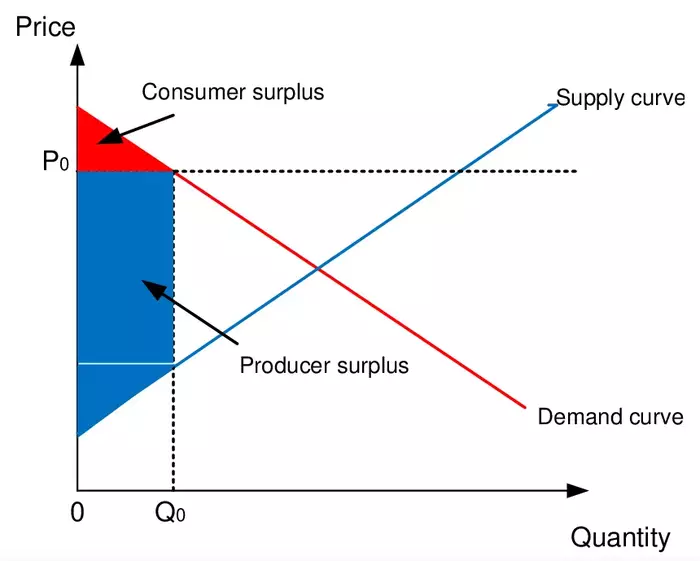

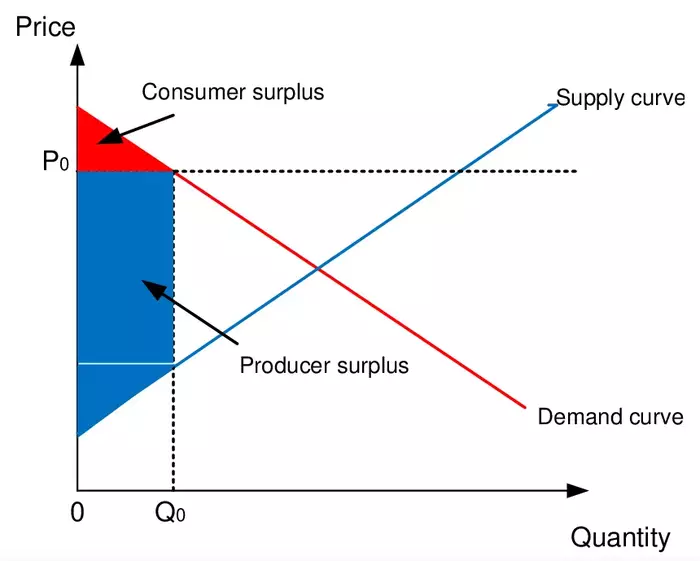

As the above graph exhibits impact of changes in data-roaming charges impacts both producer and consumer's surplus in mobile-phone market. As the data-roaming changes increases consumer's surplus will decline and also demand will also affected by small decline. On other side, producers surplus will not change by but due to decrease in demand overall effect of surplus is negative.

6

European Union believed that step of data roaming charges was an illustration of market failure. At least around 147 million EU residents currently are "roaming," i.e. using their cell phones when exploring another European nation. Consumer groups assume that very large cross-section of customers, including medium and small-sized companies (SMEs), will accept the advantages of cheaper roaming charges. Average retail rates are around four times greater for calls being made while roaming than that of the comparable prices for national phone calls. Such value disparities could not be justified by operators ' cost variations. Mobile phone market is developing rapidly with increasing technological developments and also numbers of users and operators have been increased. But even with such a rapid growth in industry, increase in data roaming charges indicates towards market failure. Because with growth in users, companies should minimize rates of data but for covering the loss they are increasing data-roaming charges.

7

The current regulation maintains price cap on charges applied by one operator to the next for handling of roaming calls on wholesale market. The regulation also notes that mark-up used to calculate retail prices that customers are currently paid for placing or receiving a phone call during roaming can not surpass 30%. Of course, providers are allowed to negotiate under wholesale cap and retail mark-up limit, paying each other as well for calls, increasing the retail mark-up or distinguishing packages of products they sell as per customer demand. The proposed regulation will also boost price visibility, that has been major roaming issue This allows mobile service operators to offer their roaming consumers with customized data about retail roaming fees – on demand and freely available. Since EU Mobile Roaming Regulations are internal market regulation applicable to European economic region, this can be anticipated to be applied in not too far future to Iceland, Liechtenstein and Norway as well.

8

Social and ethical responsibility with regards to data roaming charges: Provides of mobile-phone services should follow social and ethical responsibilities and put them on priority, but in fact they generally avoid them. Most of the services provider are efficiently providing solutions through their help line centers. Also most of the users are continuously facing the problem of call drop and excessive deduction of balance. Further they are not directly supporting the ban of unethical contents and other controversial things on internet. Companies which are engaged in providing mobile phone-services are also neg-ligating the fact about how much extent a content on internet affecting social groups, communities and other organizations. Towards increased data roaming-chargers their attitude is not so much appreciable as they are maintaining same margin even with enhanced data-roaming charges. Â Â Â

Part C – Macro Economics

10. (a):

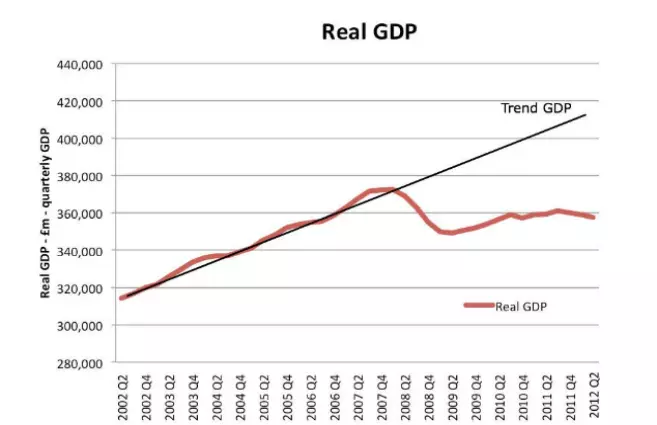

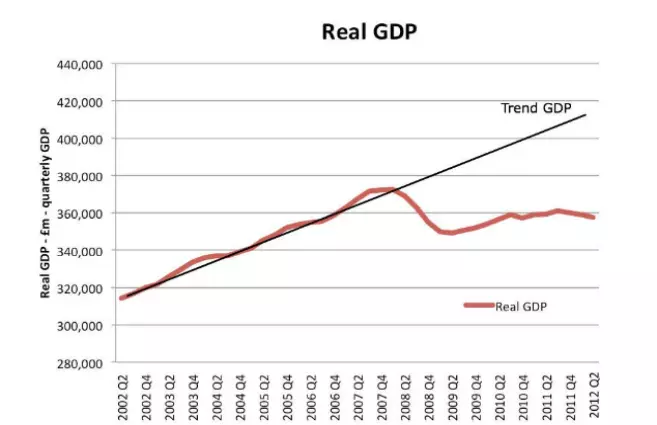

Recession periods: Great Recession relates to 2008-2013 economic recession. The recession started after global credit crisis in 2007/08, resulting in a sustained period of minimal / sluggish growth, increasing inflation, and deficit spending. The great recession, in general, exposed issues within Eurozone which suffered double-dip recession with massive unemployment. The key factor of major recession was credit crunch (2007-08) in which the international financial structure was underfunded, contributing to a fall in credibility and a decrease in bank credit. U.S. lenders have made a huge rise in sub-prime mortgages in 2000-2007. Such loans were quite volatile, and there were a lot of ' irrational exuberance ' and housing prices for values would continue to rise. US bankers lost a lot of money, but later banks around world discovered that the ' free ' packages of mortgages they purchased were in reality useless. Many banks across the globe have seen their resources decline dramatically in liquidity and valuation.

10. (b):

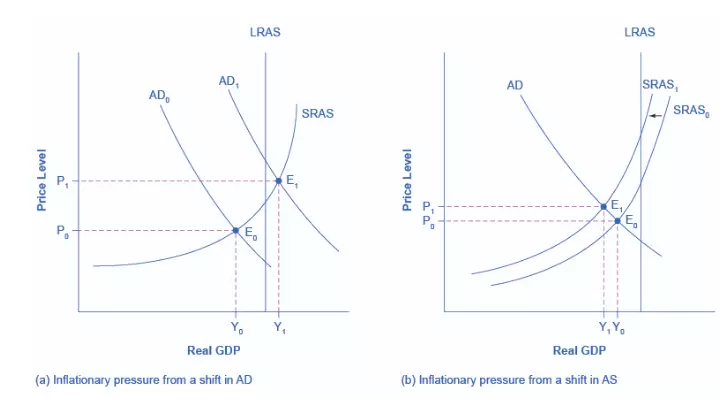

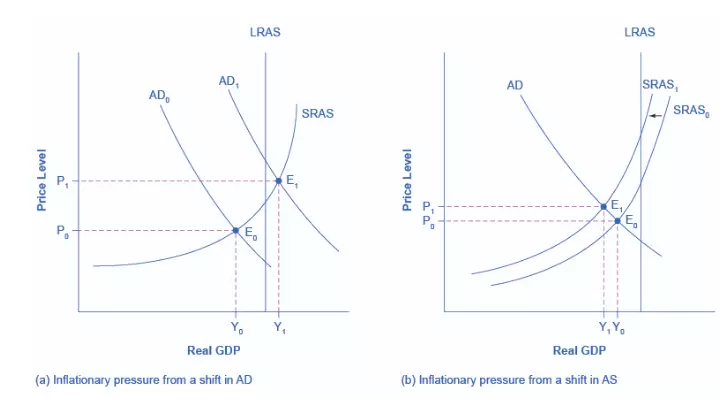

The aggregate demand / aggregate supply, or AD / AS, framework is economics ' basic method as it offers an overarching basis for putting together economical factors in one graph. We may use the AD / AS model to analyse long-term economical growth, but the variables that decide the pace of this long-run economic rate of economic growth may not exist explicitly in AD / AS diagram. Inflation changes in short-term and increased inflation rates normally happen either after or during economical booms. In event that overall demand tends to swing to right when economy is already at or close to possible GDP and high employment, moving macroeconomic balance into steep component of cumulative supply curve. One cause of inflationary forces is an increase in commodity costs that impacts most or all companies across economy — maybe a big input into output such as oil or labour.

10. (c).

Inflation will occur if, during normal economic conditions, supply of money growing faster than economic output. Inflation, or pace at which aggregate price of product or service increases slightly, may also be influenced by variables beyond supply. Inflation occurs in two forms, as per Keynesian economists: demand-pull and cost-push. Demand-pull inflation happens when customers demand products at rate greater than production, potentially due to a greater money supply. Cost-push inflation happens when input-prices for goods begin to rise at rate faster than shifts in consumer behaviour, likely due to a greater money supply. Many factors may be linked to a switch in overall supply, including revisions in lobar volume and efficiency, technical developments, wage increases, increases in manufacturing costs, shifts in producer taxation, and incentives and inflation changes. In short term, by growing supply of existing inputs in production process, total output responds to increased demand (and prices). Nonetheless, overall supply is not influenced by price level in long run and is guided only by operational efficiency upgrades and inflation.

Need Customized Essay Help?

Our Experts Can Be Your Supporting Hand!

10. (d):

The AS / AD model will describe the changes in actual GDP, inflation and unemployment for 2007 GFC period as follows. First, UK economy experienced a negative supply disruption from year-2007 to 2008 (1) as a result of deflation of a domestic real estate bubble, a doubling of the oil price, and significant price rises in other products. Such negative supply disruption describes the GFC's start i.e. the 2007/08 stagflation, as just a negative supply shock causes both increased inflation and lower production, and increased unemployment. Britain's growth rate jumped up to 0.4% in second quarter, against 0.1% at beginning of year when snowstorms and cold snap affected operation throughout the UK. With a warm summer promoting consumption, in 3 months to August, the rolling quarterly average continued to rise to 0.7 percent. The implications of outcome of referendum have already started to be felt in the UK. A drop in supply of migrant workers is starting to take shape because of the expectation that after referendum they will no longer be accepted in UK.

Get Best Essay Subject Help from Our Essay Helpers to score higher grades.

Conclusion

Form above study it has been articulated that business economics is crucial aspect which defines macro and micro factors associated with business. It enables corporation to handle the adverse economic situations. Microeconomic and Macroeconomic are two significant division of    entire business economics. Microeconomic deals with all the variables which are closely linked with business enterprises and its different products. While Macroeconomic covers wider range of factors which are not directly associated with business and belongs to extremal environment. Macro factors are more risky as in comparison of micro factors as identification of macro factors is complex task.           Â

References

- Biondi, Y. and Zambon, S. eds., 2013. Accounting and business economics: Insights from national traditions. Routledge.

- Vasant, P., 2013. Meta-heuristics optimization algorithms in engineering, business, economics, and finance. Information Science Reference.

- Herrera-Soler, H. and White, M. eds., 2012. Metaphor and mills: Figurative language in business and economics (Vol. 19). Walter de Gruyter.

- Barnett, R.A., Ziegler, M.R. and Byleen, K.E., 2015. College mathematics for business, economics, life sciences, and social sciences.

- Gillespie, A., 2013. Business economics. Oxford University Press.

- Jönsson, S., 2013. Accounting and business economics traditions in Sweden: A pragmatic view. In Accounting and Business Economics (pp. 203-219). Routledge.

- Castillo-Vergara, M., Alvarez-Marin, A. and Placencio-Hidalgo, D., 2018. A bibliometric analysis of creativity in the field of business economics. Journal of Business Research, 85, pp.1-9.

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies