This report offers comparative analysis of post-pandemic economy of the UK and Germany in the period of late 2021 until early 2025 using key macroeconomic indicators. The UK recorded moderate growth of GDP, stable employment rate, and low volatility of inflation in the context of measured monetary tightening and fiscal support. On the other hand, Germany experienced economic contraction, high rate of inflation, and increased unemployment as it was undergoing structural problems and disruptions in energy supply. Monetary measures in both countries were designed to curb the rate of inflation and boost demand where Germany’s expansive spending focused on the energy crisis (Banerjee et al., 2019). Moving forward, the UK economy is to maintain moderate growth and easing in inflation while Germany’s recovery remains fragile as business confidence stays subdued. Both economies will need to find the balance between controlling inflation and sustaining growth in the backdrop of the geopolitical and global uncertainties. The analysis indicates the vital part of customized policy responses in confronting recovery post-pandemic.For guidance on similar topics, students can benefit from professional economics assignment help to deepen their understanding and improve academic performance.

Main task

Overview of the recent economic developments

The UK and Germany have experienced significant economic issues following the aftermath of COVID-19, made worse with geopolitical tensions and energy disruptions.

- Pandemic Recovery: The two nations recorded serious contractions during the pandemic. Although Germany suffered from a 0.3% GDP contraction towards the fourth quarter of 2023, the economy is still in pressure from sluggish growth and structural problems. The UK also was struggling with a technical recession in 2023, indicating the persistence in supply chain disruptions and inflationary pressures.

- Energy Crisis: The crises in Russia and Ukraine has led to an interruption in the supply of energy, particularly for Germany which relies on the Russian natural gas. The subsequent energy price increase created tremendous pressure in various industries cost wise. Germany reacted to the soaring costs with large fiscal initiatives in excess of €100 billion in 2022-2023 to protect households and businesses from skyrocketing costs (Bordalo et al., 2020). UK also expanded its Energy Price Guarantee and introduced targeted relief schemes to counter the household energy costs.

- Inflation peaked: it has been a cardinal issue. A high inflation rate of 11.6% in late 2022 was experienced in Germany, and this was because the price of energy had increased in Germany; however, in the UK, the inflation declined to 3.7% in early 2025 but still exceeds the Bank of England’s target mark. Long-lasting inflationary strains are constantly undermining the consumer purchasing power and complicating the decision-making process about monetary policy.

- Geopolitical Tensions: The war in Ukraine and the uncertainty about global trades have messed up with the supply chains, negatively impacting exports and imports that are essential to both economies (Baqaee and Farhi, 2019). Germany’s export-based economy has witnessed declining demand; the UK drowns in the complex policy of trade after leaving the Union against the emergent US-UK relationships.

- Policy Responses: Both states resorted to use of fiscal stimulus and monetary tightening. Germany expanded the government expenditure to boost the economy and UK introduced tax reliefs and energy subsidy. The Bank of England reduced interest rates to 4.25% in May 2025 and it aimed at stimulating growth but catering for inflation fears (Tucker, 2023).

- Macroeconomic Challenges: Major challenges include the ability to check on the inflationary pressures, reduce dependence on energy, and sustain growth despite global uncertainties. These factors determine the economic situation of the two nations as they both exit the pandemic.

Comparative economic indicators analysis

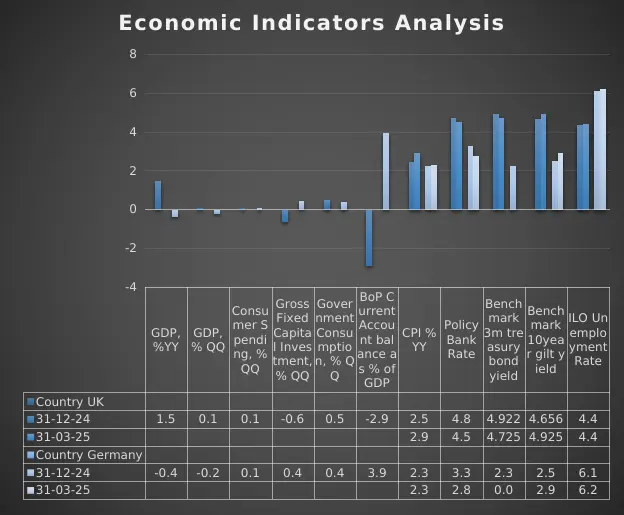

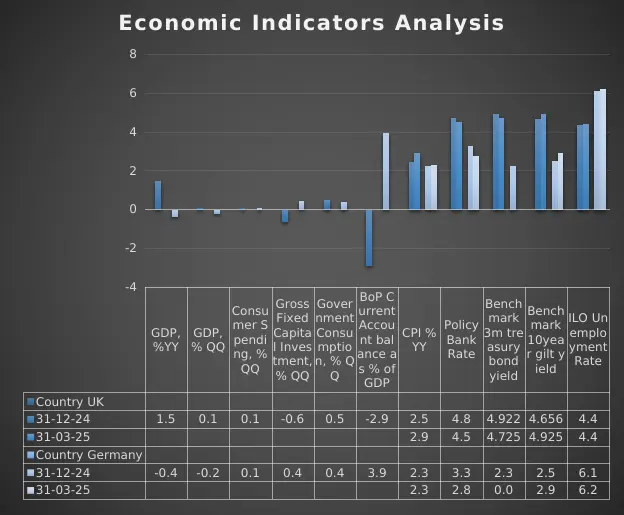

Figure 1 Indicators of the economy

Source- Self

The economic indicators for the UK and Germany as of the last quarter of 2024 and the first quarter of 2025 paint distinct paths that represent each country’s own macroeconomic context, policy measures, and distinct structure.

GDP Growth and Economic Activity

The UK showed a slight, yet positive YoY 1.5% GDP growth for Q4 of 2024, managing to hold onto a somewhat stagnant quarterly growth rate of 0.1%. On the other side, Germany’s GDP decreased by 0.4% YoY and 0.2% QoQ thus pointing towards lingering economic headwinds (De Loecker, Eeckhout and Unger, 2020). The UK’s small GDP growth indicates a weak but sustained recovery while Germany’s contraction points to the structural factors, maybe associated with the external demand shocks and energy crisis. Consumer spending continued to expand by a 0.1% QoQ basis countrywide and in every country that recorded growth. This is evidence of sustained household demand despite inflationary headwinds. However, the gross fixed capital investment went different ways. UK was down by 0.6% QoQ, a sign of prudent business growth in an uncertain economy, Germany up by 0.4%, a somewhat buoyant business capital formation. The government consumption demonstrated a mild increase of 0.5% in UK and 0.4% in Germany, signalling the latter’s continued support of the public services and the economy (Muhammad Ridwan, 2022).

Inflation and Monetary Conditions

Inflationary dynamics differ markedly. UK’s Consumer Price Index (CPI) recorded a deflationary figure of -2.9% YoY in Q4 2024, turning positive with 2.9% rise in Q1 2025, suggesting volatile rise in prices which might have been influenced by energy and supply chain normalization. Germany had high inflation at 3.9 % YoY in Q4 O2024 and declined to 2.3% Q1 O2025 (reflecting broader European inflationary acceleration due to the energy and food prices). In the UK, broad money supply growth decelerated strongly from 2.5% YoY to 0.8%, which indicates tighter liquidity conditions and possibly a reaction to tightening in money. Broad money supply growth in Germany was constant at an average of 2.3% meaning that its credit position was stable. The Bank of England kept a higher policy rate, which has softened from Q4 2024 – 4.8% to 4.5% in Q1 2025, which shows a cautious policy that aims for the control of inflation and growth support. At the same time, the policy rate of the European Central Bank’s (ECB) increased from 3.3% to 2.8% but with intervals that indicated monetary tightening, however, at a lower rate than in the UK. Benchmark bond yields captures these differences (Eichenbaum, Rebelo and Trabandt, 2021). The 3- month treasury bond yield of the UK declined slander from 4.922% to 4.725%; the 10- year gilt yield also rose slightly, recording 4.656% from 4.925% thus investors seek higher premiums for the long-term risks. Germany’s shorter 3-month yields on bonds brought give-way to zero by Q1 2025 with 10 years rising modestly from 2.5% to 2.9 % giving relative confidence in German sovereign debt.

Credit Conditions and Exchange Rates

There was an increase in lending to private non-financial corporations in both countries with UK loans going from around £440 billion to £443 billion and Germany loans up from around €3.98 trillion to €3.99 trillion, reflecting that credit was still available for businesses even after the uncertainty of the economy. BIS Real Effective Exchange Rate index indicates that in both economies there is a depreciating trend; in the UK, the rate declined from 111.7 to 110.5, and Germany – from 100.2 to 98.9, which implies the adjustment of currencies that may affect competitiveness of trade.

Labour Market and Earnings

Contrasting conditions are visible from the indicators of labour market. Unemployment within the UK did not change either, which indicates a strong labour market, being 4.4%. The unemployment rate in Germany inched up from 6.1 percent to 6.2 percent which is representative of increased slack in the labour market perhaps because of sluggish economic activity. The average weekly earnings had experienced a little increase in both countries (Elenev, Landvoigt and Van Nieuwerburgh, 2021). The UK 3-month average earnings growth advanced from 5.6% YoY growth to 5.8% YoY against Germany’s rate which slowed down from 126.0% YoY to 106.8%. The German number looks also abnormally high, possibly due to statistical anomalies or base effects, but the series declines seem to indicate pressure release in wages.

Business Sentiment

Purchasing Managers’ Index (PMI) values propose business confidence is low. The PMI for the UK was steady at 50.9, slightly above that of 50 (neutral threshold) indicating marginal growth. Germany’s PMI rose from 42.8 up to 46.6, still in the contraction territory but improving, signalling cautious optimism.

Summary and Implications

As a whole, the economy of the UK shows some signs of its recovery, including stable consumption, decreasing volatility of the inflation, and strong labour market. But lack of strong investment and restrictive monetary policy suggest the doubts beneath. The economy of Germany has more difficulties to overcome with the contracting GDP growth, prolonged inflation, and increasing level of unemployment coupled with the guarded approach of business. Still, stable capital investment and the rising PMI indicate prospects of slow recovery (Fornaro and Wolf, 2020). An appreciation for balance in the two countries techniques lie in curtailing inflation as well as spurring growth with UK adopting a higher interest rate bearing position. Credit growth and lending is good, sustaining business operation. The diverging paths shed the light on the relative economic flexibility of the UK compared to the structural rigidity of Germany on the dependence on energy and exposure to the external demand. These trends are the context in which monetary policies are decided and the strategies for the fiscal context in the moving towards recovery after the pandemic and in the current global uncertainties.

Policy discussion and theoretical analysis

Different responses to fiscal and money policy have played a massive role in the post-pandemic economic trajectory of the UK and Germany. Bank of England (BoE) has adopted a relatively tight monetary policy, keeping policy rates at around 4.5% in order to tame inflation sentiment that was volatile in end of 2024 to early 2025. This strategy conforms to macroeconomic doctrine that increasing the real interest rates lessen the overall demand thus alleviating inflation (as stipulated by the IS-PC-MR model). The UK’s inflation turnaround from its deflationary state to a moderate inflation provides a testimony of the finesse that BoE applies as it attempts to strike a balance between price control and supportive fragile GDP growth (Gregory, 2020).

However, compared to the European Central Bank’s (ECB) policy rates that impact Germany, the rates have been relatively lower (approximately 2.8-3.3%), which is a way of taking a more accommodative stance to help revive growth as the country records a contraction of GDP and an increase in the unemployment rate. Germany’s high inflation despite the negative output growth points to supply side shocks like those of energy price increases which constrain the actions of ECB to tighten policy aggressively without compromising the economic activity any further.

Fiscal policies also diverge. The UK undertook targeted relief measures such as energy subsidies and relief from taxes as a way of supporting household demand and relieving cost of living pressures. Germany increased its fiscal policy involving over €100 billion, to resolve the energy crisis and economic stability. Such fiscal expansions expand aggregate demand and boost the palliative effect on the negative output gap but cause concerns on the long-term fiscal sustainability. Overall, the policy mix of the UK involves inflation control on the basis of monetary tightening supplemented by selective fiscal support, compared to Germany’s reliance on more expansive fiscal measures enhanced with a cautious monetary plan (McKibbin and Fernando, 2020b). Such strategies are a reflection of economics in the nations as well as theoretical principles used in the work of macroeconomic stabilization.

Below are the three graphs that depict the theoretical relationships of the 3-equation model used on your UK and Germany data.

IS Curve: Output Gap and the Real Interest rate

Figure 2 IS Curve

Demonstrates such a negative relationship of output (quarterly GDP growth approximated) and the real interest rate (nominal policy rate – inflation). UK’s higher real interest rate and almost zero output growth is different from Germany’s lower real rates but negative output growth.

Phillips Curve: Inflation vs Output Gap

Figure 3 Phillips Curve

Shows classical relationship between inflation and output gap with the former moving upwards. Strong supply shocks explain the state of high inflation in Germany, with changes in the output movements being more aligned with the UK’s inflation.

Monetary Policy Reaction Function: Interest Rate vs Inflation

Figure 4 Monetary Policy Reaction

Shows how central banks change the nominal interest rates in order to offset inflation deviations. UK has a stricter monetary stance compared to Germany and thereby has higher policy rates at similar rates of inflation (Kumar, Yuriy Gorodnichenko and Olivier Coibion, 2023).

These graphs do well in illustrating the visual connection between the data and the macroeconomic theory whereby monetary policy and inflation-output dynamics between the two countries in your analysis differ.

Near future outlook and predictions

Looking into the future, the UK and Germany both have a hopefully positive with the caveat of uncertainty economic environment ahead. Its modest GDP development and steady unemployment rate imply the ability to resist, but its high rate of rise in incomes and instability of inflation indicate that inflation threats still exist. The Bank of England is expected to remain cautious in monetary policy position, weighing against the possibility of additional rate hikes by the risk of slowing growth. Leading indicators, including the constant Purchasing Managers’ Index (PMI) at 50.9, signal continuous but rather dull growth. Inflation is likely to diminish gradually once supply chain disruptions are eased and as prices normalize on energy, helping to achieve gradual recovery to price stability by late 2025. The short term prospects of Germany remain more difficult. GDP contraction and increments in unemployment reveal structural problems that are exacerbated by external shocks and dependence on energy. Regardless of the fact that the PMI has increased, it is still below the expansion level and suggests weak business confidence. The moderate accommodative monetary policy pursued by the European Central Bank is meant to support growth without lighting up the flames of inflationary pressures, which are forecasted to subside gradually (McConnell, 2020). Fiscal measures aimed at energy relief and incentives for investment will be essential to create demand.

Overall, both economies will be operating on a tight rope. sustaining inflation but creating sustainable growth. Geopolitical and global supply chain reconfigurations in combination with volatility in the energy markets will have a notable impact on the choices made in policy and growth to 2025.

Don’t Miss Out

Conclusion

Concluded that the Comparative analysis discloses the fact that the UK and Germany are on different tracks of post-pandemic recovery underpinned by different economic structures and policy reactions. Generally, the UK’s relatively small GDP growth, low rate of labour market instability and a vigorous monetary tightening all point to a guardedly positive outlook in spite of latent inflationary pressure and miserly investment. Economic contraction, high inflation, and increased unemployment in Germany signify structural vulnerabilities and dependence on energy imports but is partially damped by the expansive fiscal and more accommodative monetary stance (McKibbin and Fernando, 2020a). Both countries grapple with inflation control, while at the same time they need to support growth against the backdrop of geopolitical uncertainties and global disruptions to the supply chain. Individualized fiscal and monetary policy would be critical in maintaining a recovery rate, stabilizing the prices, and improving the economy’s resilience. Over the short period ahead, both economies will continue to be shaped by constant tracking of core indicators and agility in policy adjustments.

References

Banerjee, A., Beraja, M., Caballero, R., Chernozhukov, V., Costinot, A., Fornino, M., Hazell, J., Jadbabaie, A., Kakhbod, A., Karaduman, O., Kermani, A., Lashkari, D., Lazar, C., Mikusheva, A., Patterson, C., Rafey, W., Sastry, K., Schilbach, F., Simsek, A. and Strack, P. (2019). Macroeconomics with Learning and Misspecification: A General Theory and Applications * Pooya Molavi †MIT Job Market Paper. [online] Available at: http://red-files-public.s3.amazonaws.com/meetpapers/2019/paper_1584.pdf  [Accessed 15 May 2025].

Baqaee, D.R. and Farhi, E. (2019). The Macroeconomic Impact of Microeconomic Shocks: Beyond Hulten’s Theorem. Econometrica, 87(4), pp.1155–1203. doi: https://doi.org/10.3982/ecta15202.

Bordalo, P., Gennaioli, N., Ma, Y. and Shleifer, A. (2020). Overreaction in Macroeconomic Expectations. American Economic Review, 110(9), pp.2748–2782. doi: https://doi.org/10.1257/aer.20181219.

De Loecker, J., Eeckhout, J. and Unger, G. (2020). The Rise of Market Power and the Macroeconomic Implications. The Quarterly Journal of Economics, 135(2), pp.561–644. doi: https://doi.org/10.1093/qje/qjz041.

Eichenbaum, M.S., Rebelo, S. and Trabandt, M. (2021). The Macroeconomics of Epidemics. The Review of Financial Studies, 34(11). doi:Â https://doi.org/10.1093/rfs/hhab040.

Elenev, V., Landvoigt, T. and Van Nieuwerburgh, S. (2021). A Macroeconomic Model With Financially Constrained Producers and Intermediaries. Econometrica, 89(3), pp.1361–1418. doi: https://doi.org/10.3982/ecta16438.

Fornaro, L. and Wolf, M. (2020). Covid-19 Coronavirus and Macroeconomic Policy. [online] papers.ssrn.com. Available at:Â https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3560337.

Gregory, M.N. (2020). Brief Principles of Macroeconomics. Thanglong.edu.vn. [online] doi:Â http://thuvienso.thanglong.edu.vn//handle/TLU/11898.

Kumar, S., Yuriy Gorodnichenko and Olivier Coibion (2023). The Effect of Macroeconomic Uncertainty on Firm Decisions. Econometrica, 91(4), pp.1297–1332. doi: https://doi.org/10.3982/ecta21004.

McConnell, C. (2020). Macroeconomics. Thanglong.edu.vn. [online] doi:Â http://thuvienso.thanglong.edu.vn//handle/TLU/11885.

McKibbin, W. and Fernando, R. (2020a). The Global Macroeconomic Impacts of COVID-19: Seven Scenarios. Asian Economic Papers, [online] 20(2), pp.1–55. doi: https://doi.org/10.1162/asep_a_00796.

McKibbin, W.J. and Fernando, R. (2020b). Global Macroeconomic Scenarios of the COVID-19 Pandemic. SSRN Electronic Journal. doi:Â https://doi.org/10.2139/ssrn.3635103.

Muhammad Ridwan (2022). DETERMINANTS OF INFLATION: Monetary and Macroeconomic Perspectives. KINERJA Jurnal Manajemen Organisasi dan Industri, 1(1), pp.1–10. doi: https://doi.org/10.37481/jmoi.v1i1.2.

Tucker, I.B. (2023). Macroeconomics for today. Thanglong.edu.vn. [online] doi:Â http://thuvienso.thanglong.edu.vn//handle/TLU/11487.

You May Also Like To Read :

ECONOMICS OF TOURISM

Thematic Analysis | For Qualitative Research Purpose

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies